One employee benefit option for an employer is to introduce a funeral benefit for all employees. A benefit which targets the provision of a death cover of $10,000, $20,000 or $30,000 and promoted as funeral cover, is a cost effective way of providing a benefit that is often highly valued by employees. It is also a benefit which can usually be put in place without the need for employees having to provide medical evidence.

By providing a funeral benefit through SuperLife, the employer also gives the employee the added advantages of being able, at their cost, to:

- increase the level of their cover to provide for other needs, and/or

- extend the cover to include total & permanent disablement, and/or

- include their spouse/partner.

They can also take out income protection and medical insurance, and save for their retirement and incorporate KiwiSaver. The employer need not subsidise the additional benefits, but gains from the advantage it confers on the employee, of SuperLife’s premium rates – we do not pay or receive commissions.

Cost

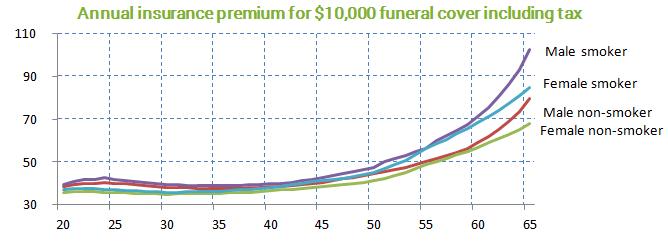

The cost to an employer of providing a funeral benefit depends on the demographic profile of the employer’s employees. The cost for a smoker is more than that of a non-smoker, at the same age. Males are also different to females. The graph plots sample costs below for individuals. It will be the overall cost for all employees that matters to the employer. This will depend on the demographics of the employees.

In addition to the premium cost, is the cost of the associated tax. As the benefit is through SuperLife workplace savings scheme under the Financial Markets Conduct Act 2013, the tax regime is the employer superannuation, tax regime (ESCT) and not the FBT regime. This has the same tax rates as the FBT regime but has higher bands and so potentially less tax is paid. There is also generally less administration hassle. The provision of a funeral benefit to employees though SuperLife, is therefore tax and administratively efficient.

For a typical employer’s work force, we would expect the cost to be about $55 a year, on average, including ESCT, per employee. But the cost will vary depending on the actual demographic profile and how to change over time.

Benefit to employer

By introducing a funeral benefit through SuperLife, the employer gains:

- a key employee benefit that employees will value;

- the knowledge that should an employee die, their family receives money to help with the financial costs, they incur at the time;

- access to the SuperLife consultants to explain what the company does for its employees and to explain it to staff – SuperLife does not receive or pay commissions. SuperLife provides access to wholesale, commission free savings and insurance options.

Additional benefits for employee

The funeral benefit provides a base benefit. Under SuperLife, employees can supplement this with extra life insurance and/or insurance for life, disability (income protection) and medical costs. KiwiSaver and other superannuation savings are also available. To pay for the extra benefits, the employee has the convenience of payroll deduction or direct debit from their bank account, on a seamless basis.

When an employee leaves the service of the employer, they can choose to continue their benefits.

What can an employer expect?

By implementing a funeral benefit through SuperLife, an employer can expect:

- a SuperLife consultant to support them with site visits as often or as little as the employer chooses;

- their employees to receive regular statements showing them their benefits and the value of the employer subsidy to meet the cost of the benefits. The standard practice is an emailed statement on a monthly basis;

- their employees to get access to additional, commission-free insurance and savings options.

To implement a funeral benefit for your staff:

- Make the decision. If you need a cost indication, contact SuperLife with details of your employees’ profile;

- Let SuperLife prepare promotional material;

- Organise for SuperLife consultants to explain the benefit and additional options to your staff.