In New Zealand, employers can provide employee benefits through a combination of superannuation schemes, insurance policies and KiwiSaver. Employees who join KiwiSaver and save 3% by payroll deduction normally receive an employer contribution of 3% and the government will also subsidise their savings up to $521.34 a year. But KiwiSaver, because of the lock-in, does not suit all employees and therefore creates remuneration inequities. For many employers, it makes sense to introduce flexibility and give employees choice. Different HR approaches fall into three groups:

- Reactive - i.e. KiwiSaver compliance only

- Proactive - i.e. encourage staff to look at KiwiSaver

- Flexible - i.e. extend KiwiSaver to include other superannuation

Most employers fall into the first group and employee benefits do not form part of the HR strategy. KiwiSaver is seen in the same light as other taxes and levies. KiwiSaver and wider employee benefits are not perceived as being able to create a HR advantage.

Many employers however, see a benefit in facilitating an employee to save for their retirement. They therefore encourage employees to save by raising the awareness of KiwiSaver, and in some cases making available a supplementary superannuation scheme. For these employers, the tax imposed on employer contributions to KiwiSaver gives KiwiSaver no advantage relative to wider superannuation and so gives the employer greater scope to help their employees meet their financial needs and to differentiate itself. This can be at no additional cost to the employer.

In the current environment, it makes sense for KiwiSaver to become the base of an overall “Simple Super” strategy. The basic Simple Super strategy for an employer is:

- Decide on the overall subsidy level they are willing to pay. Most will adopt 3% to reflect KiwiSaver. Some will set a higher rate (e.g. 4%, 5% or 10%). The message is:

You pay X%, I pay Y% (less tax). Note: X can equal Y.

- Subject to the KiwiSaver Act requirements, let employees choose whether the savings go to a superannuation scheme or to KiwiSaver. This does not change the cost to the employer or the tax treatment. Both are fully taxed the same under the ESCT rules. The message is:

You choose; super or KiwiSaver or split.

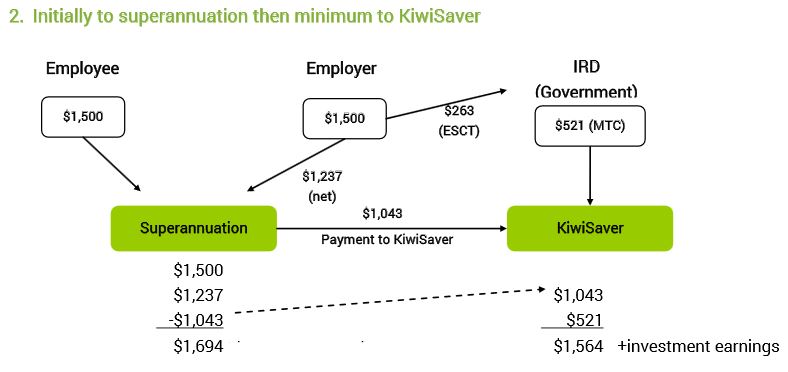

- Let employees transfer money (e.g. $1,043) from their superannuation scheme to KiwiSaver each year and pick up the maximum government $521 MTC payment to KiwiSaver.

Most employees should have a combination of KiwiSaver and non-KiwiSaver savings. Given a choice, most employees will direct their savings to super and then transfer the $1,043 to KiwiSaver each year. This maximises their savings (i.e. captures the government subsidy) and maximises their flexibility, relative to their needs. It also helps the employer and the employee prepare for events like early retirement.

To implement Simple Super, SuperLife offers the optimal solution. It is flexible and low cost. It also lets insurance benefits be included on a subsidised or voluntary basis to provide a wider employee benefit programme.

Example - Simple Super

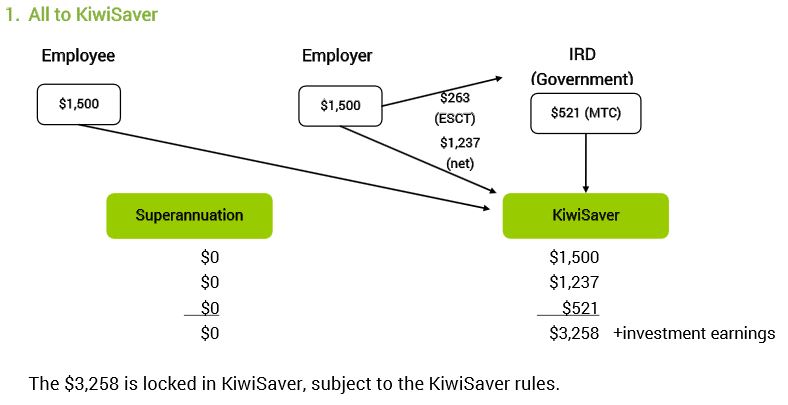

For an employee on $50,000 a year and assuming a 3% contribution (3% x $50,000 = $1,500), the position is:

Both options give the same total savings of $3,258. Under KiwiSaver, it is all in KiwiSaver and subject to the KiwiSaver Act, lock-up rules. Whereas under the simple super option, $1,694 is not locked up and is ultimately available to facilitate early retirement and other HR requirements. In both cases, the employee captures the $521 from the government. Employees could also choose to have it all go to Super and forego the $521 from the government each year. With SuperLife, the transfer of the $1,043 each year can occur automatically by the employee ticking a box on the contribution or membership form.