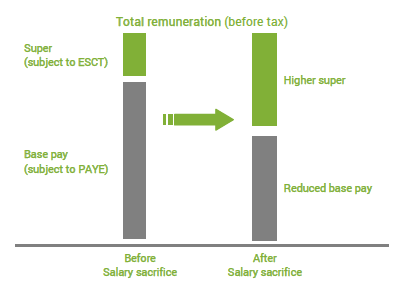

Salary sacrifice is where an employee packages (i.e. swaps) part of their cash pay, to receive remuneration in another form more suited to their needs, such as higher employer contributions to a superannuation scheme.

From an employer's perspective, encouraging salary sacrifice results in employees building a higher level of wealth for their retirement, and having greater individual accountability for their retirement savings and financial health. Both of these factors must benefit an employer in managing its employees.

Salary sacrifice is perhaps more relevant to employers with a total remuneration philosophy. By sacrificing salary and receiving a higher employer contribution, an employee receives lower immediate income, but higher deferred income. The amount sacrificed shifts from being taxed under the PAYE system to the ESCT system.

The total value of the gross remuneration, and cost to the employer, remains unchanged. However, depending on the employee's income level, the net remuneration may increase because of the different tax treatment for some income bands.

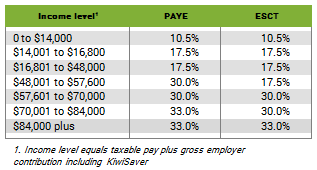

For employees earning less than $84,000, a benefit arises if it lowers the tax rate otherwise applicable. For employees who earn between $14,001 to $16,800, $48,001 to 57,600 and $70,001 to $84,000, salary sacrifice results in higher net-of-tax remuneration because of lower tax. It therefore lets them save for their retirement out of income that is effectively taxed at a lower rate (e.g. 30% ESCT and not 33% PAYE).

Other employees (between $16,801 and $48,000 and between $57,601 and $70,000 and above $84,000) do not benefit from salary sacrifice.

The ESCT rate depends on the total of direct taxable pay and the employer's total contributions to superannuation in respect of the employee. The marginal tax rates of the PAYE system and ESCT regime are:

Besides higher net remuneration, there are several other issues to be considered.

ACC

ACC income benefits and levies are based on salary up to $120,070 (1 April 2015). Where employees sacrifice salary below this level, they save on their own ACC levy (likewise, so does the employer) but will also reduce any ACC income-related benefit that becomes payable. Some employees may therefore not wish to sacrifice below this level. Any employee who does, should separately evaluate their disability income needs and employers may wish to make employees aware of the potential consequences.

Employers will also need to ensure that their life and disablement insurance policy can cope with the sacrificed salary and for the insurance formula to be based on a notional salary (e.g. equivalent gross remuneration).

Payroll system

A key administration issue relates to the payroll system. Employers will need to determine whether it can handle multiple definitions of salary, variable employer contribution rates and multiple ESCT rates.

Access

Where salary is sacrificed to a non-locked in scheme, should an employee have access prior to retirement? This is a philosophical issue. From the employer's viewpoint, it does not result in any extra costs or extra tax.

Most employees will not withdraw money, as they will want to save it in the scheme (provided it has a high level of flexibility). However, knowing they can access the sacrificed salary, if they need to, will provide a level of comfort and security.

Investment issues

Employees who sacrifice salary for retirement savings purposes will generally have above average wealth and will want the investment of these assets to be part of their overall investment strategy. Many may want a higher or lower level of share investments, than many superannuation schemes provide for. Likewise, those employees looking to access their sacrificed salary (e.g. for a first home deposit) will want a greater focus on certainty and therefore cash assets.

For investment reasons, salary sacrifice will probably increase the demand for more flexible investment choice.

KiwiSaver

With the standard superannuation ESCT (employer superannuation contribution tax) tax regime applying to the employer contributions to KiwiSaver and equivalent complying locked-in schemes, salary sacrifice provides a small tax advantage to employees looking to save for their retirement or to buy their first home.

If someone is saving for retirement, why would they not take advantage of the tax concessions no matter how small? Also, because contributions paid to KiwiSaver can be withdrawn in some circumstances, e.g. to help buy a "first home," salary sacrifice will be a great way to help qualifying people save for a deposit.