Welcome

Welcome to the December quarter news. From all the team at SuperLife, we wish you a successful and peaceful 2019.

This quarter we provide an update on market activity where global and New Zealand equity markets suffered large declines in the December quarter. However, in January markets have already started to recover.

We have included a section on volatility in investment markets which reminds us that while no investor likes a negative return, it is important to keep in mind that the market volatility of the past few months is not unusual. We also saw the potential for global recessionary conditions to emerge over the near future. Equity market volatility is not historically unusual, and it’s a key reason why investors earn a higher return on equities than cash over long-term horizons. This is explored further in the section on volatility in investment markets below.

See how your own investment strategy has performed:

Our regular My Future Strategy update reminds us that it is important not to be spooked by the recent market volatility. Time and time again, history suggests markets recover from periods of weakness. See the member’s story for an insight on reacting to negative returns.

Also in this edition:

- Volatility in the investment markets

- Coping with market volatility - a member’s story

- Taking the lifecycle approach to investing

- Changes to Fund updates

Get more information on SuperLife’s 41 investment options and returns

Market Update

Investment returns

Market commentary

Global and New Zealand equity markets suffered large declines in the December quarter. Interest rates rose in the US, Brexit was deadlocked, trade tensions between the US and China continued, and there was a partial US government shutdown. There were some weaker than expected corporate earnings for bell-weather stocks such as Apple. We also saw the potential for global recessionary conditions to emerge over the near future. Equity market volatility is not historically unusual, and it’s a key reason why investors earn a higher return on equities than cash over long-term horizons. This is explored further in the box below.

International equities

International developed market equities fell by around 15.5% over the quarter, implying a 4.5% return for the 2018 year (FTSE Developed All Cap Index in NZ dollar terms). Within global equities, the decline was larger in “growth” and small cap stocks which are more sensitive to changes in perceptions of the economic environment.

Emerging markets

In contrast, emerging markets, which are also normally more sensitive to a major downturn, fell by only 7.9% in the quarter (FTSE Emerging Markets All Cap Index). This partly reflects them earlier bearing the brunt of trade war fears. It may also reflect a view by many equity analysts that emerging markets now offer particularly good-value for investors.

Trans-Tasman equities

These markets did not escape the sell-off. Australian equities declined around 11.7% (ASX 200 Index), with small caps being hit harder in line with the international experience. NZ equities were relatively robust to the global sell-off, falling by around 5.5% (S&P/NZX 50 Portfolio Index). This left the 2018 calendar year return for the NZ equity market at around 5.2% - a strong result compared to most other equity markets.

Bonds

These offered some respite to the equity markets sell-off, as should be expected in times of market stress. NZ bonds returned around 1.3% for the quarter and 4.4% for the year (S&P/NZX A-Grade Corporate Bond Index). This return is well ahead of short-term cash rates and term-deposits, indicating that NZ bonds have offered a good premium. International bonds also returned 1.5% over the quarter (Bloomberg Barclays Global Aggregate Index).

The fortunes of these different markets are reflected in Superlife’s Fund returns. SuperLife Income, which has no exposure to equities, had a positive return of around 0.4% over the quarter. The moderate risk SuperLife 30 fund fell around 2.4%, while the high risk SuperLife 100 fund fell 10.3%.

Volatility in equity markets

No investor likes a negative return, but it is important to keep in mind that the market volatility of the past few months is not unusual. We have seen as large or larger declines in markets regularly in the past, including 2011, during the GFC in 2008/2009, the early 2000s and in 1987. (US post-WW2 data suggest that the US equity market has a decline of 10% or more on average every 18 months).

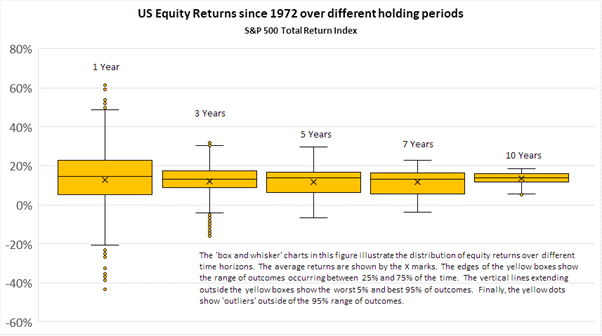

We also know that investors across most equity markets, including New Zealand’s, have historically been amply rewarded for bearing such short-term market volatility. The graphic below uses monthly data for the US equity market since 1972. It shows that at a one-year horizon there is a very wide spread in returns. As the investment horizon increases, this return volatility diminishes. At a 10-year holding period, most returns are tightly clustered around the average return (of around 13%), and that even the worst 2.5% of returns at this horizon are still positive. We see similar patterns in other equity markets.

This higher long-term return has also been enjoyed by long-term SuperLife investors. The 5- and 7-year returns (after fees and taxes) for all SuperLife KiwiSaver scheme and workplace savings scheme funds remain materially higher than the returns on NZ cash, despite the recent weakness. In addition, higher returns are seen in the funds with higher exposure to equities, in line with their higher risk and return levels.

History also suggests that often the largest gains in markets occur around a period of weakness, and recovery times after a sell-off are usually months rather than years. This implies that investors who reduce their holdings of equities in a down-market may fail to participate in these gains; instead, they lock in the losses. This observation and the fact that investors are rewarded for bearing volatility over long horizons suggests staying the course is likely to be their best option.

Finally, while some commentary suggests the weakness in markets implies an economic recession is imminent, this is by no means a certainty. Markets have got it wrong many times in the past. Way back in the 1960s, Nobel Prize-winning economist Paul Samuelson quipped that the US equity market had forecast nine out of the past five recessions in recognition of this fact!

Coping with market volatility - a member's story

One of our SuperLife members, (let’s call her Jane) had $850,000 invested in SuperLife using the SuperLife Age Steps allocation (age 65). Her use of funds is likely to be over the longer term with some cash requirements earlier.

Jane was concerned about the December quarter loss of $73,000, and the potential for further losses. After discussing this with her accountant, Jane decided on a switch on her account.

| Before | After | |

| Cash/income | 38% | 60% |

| Shares | 62% | 40% |

As well as changing the mix, she also chose not to have her new strategy rebalanced automatically. This means that unless she actively rebalances her investments herself, she could get out of kilter when markets move.

What’s the impact of these decisions?

Jane is more comfortable, having reduced her exposure to shares by 22%, however she will miss out on the upside on that amount (if/when it comes). She has also protected herself from a further downside loss if markets continued to drop.

In the first two weeks of January, markets came back with a $15,000 gain up to the date of the switch. That gain was on Jane’s “before” strategy, but future returns will be based on the “after” strategy where shares account for 40% rather than 62% of her investment.

Jane asked if she could move the money back later. She can, but she could then be in the classic situation of having sold while markets are down and buying back in at a higher price if the markets have improved since she switched out.

The moral of the story

In Jane’s case, she made a change that made her more comfortable but did she fully understand the impact? The important thing to remember before changing strategy is not to be spooked by market volatility, make sure you know what the effect of the change might be and check your reasons for making the change. Some steps to consider are:

- Review your strategy: markets are, and always will be, uncertain. Review your strategy and goals, keeping in mind your key timeframes:

- short-term: 0-3 years – certainty

- medium-term: 4-9 years – income

- long-term 10 years plus – inflation protection

- Review your appetite for risk: can you live with the current short term volatility in the share markets knowing those funds are your long-term investments?

- Does the SuperLifeAgeSteps option meet your goals? – SuperLifeAgeSteps automatically sets the proportion of income and growth assets based on your age. As you age, the proportion of your investment in more volatile growth assets reduces, lowering the expected size of the ups and downs in the value of your investment.

- Do you prefer to choose your own mix? If you choose to create your own mix, think about having the auto-rebalancing so that your investments are automatically rebalanced to your mix, otherwise you must actively manage your investment yourself.

- Be informed: to help you make informed investment decisions, we have a range of online resources for you to draw from. View our articles and guides and recent newsletters. The Government’s Sorted website also includes a number of useful tools on KiwiSaver, investing and savings.

My Future Strategy

As discussed in the Market Update section, it is important not to be spooked by the recent market volatility. Time and time again, history suggests markets recover from periods of weakness. The risk of permanent capital loss is minimal given this pattern, along with SuperLife funds being broadly diversified across NZ and offshore markets. This means that even if some companies fail within an equity market, it will not materially impact your returns.

For investors with long-term horizons, staying the course with your present investment strategy is usually the best option, subject to your goals, objectives and cash needs remaining broadly the same as when your strategy was established.

Investors concerned with performance over a medium-term horizon (the next three to five years or so) may see an opportunity to enhance returns by tweaking your allocation to cash, bonds, equities and property stocks as follows:

- Holding less in bonds and, therefore, more cash and shares. This reflects the view that with the sell-off, equity markets are now cheaper, while for bonds there is still risk that interest rates may increase more quickly than is currently factored into bond prices

- Favouring value, emerging market, Australian and European equities compared to US and NZ equities. These latter markets are broadly assessed to offer less value (upside return potential) than other markets

- Maintaining holdings of property stocks at around your long-term allocation

- Maintaining the currency hedge on overseas shares at around your long-term allocation. Our interest rates are still slightly higher than foreign rates on a global market capitalisation (e.g. MSCI World Index) basis. This means hedging global equities will still earn investors a positive “carry”

This strategy doesn’t take account of personal circumstances; rather it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or long-term may not pay-off over the very short-term. No one can consistently predict what’ll happen over the short-term.

Taking the lifecycle approach to investing

This quarter, following feedback from some members, we highlight how SuperLife’s lifecycle investment option, SuperLifeAgeSteps works and what makes SuperLife different from other providers.

SuperLife is one of the few KiwiSaver providers whose “default” investment option is a lifecycle one. The “default” option with most providers is a conservative strategy investing in low risk, low return options. SuperLifeAgeSteps provides our members with an investment strategy aligned with their age. This ensures SuperLifeAgeSteps members don’t miss out on the potential higher returns that can be achieved from being invested in growth assets.

The government says it will be reviewing the default conservative investment strategies used by some KiwiSaver schemes later this year. The negative effect of conservative strategies on the longer-term outcome for KiwiSaver members has also been discussed in the media.

How does it work?

Under the SuperLifeAgeSteps option, your savings are invested in a mix of assets according to your age.

As you age, the proportion of your investment in more volatile growth assets (shares/property) reduces automatically, lowering the expected size of the ups and downs in the value of your investment.

Under this option, you don’t have to worry whether you are in the right mix of growth and income assets for your age – we do that for you. As your savings grow, we regularly rebalance that appropriate to your age.

This option may be suitable if you are saving for retirement (assumed to be age 65). It assumes you will continue to invest your savings and spend them over your retirement period.

Meet Geoff

Geoff’s a smart 20 year old invested in SuperLifeAgeSteps where 96% of his investment is in growth assets and only 4% in income assets. Why? He’s saving for retirement 45 years away. When share markets go down, Geoff may be affected, but he has time to recover. Geoff turns 40 and we’ve moved his growth share down to 80% and raised income to 20%. By the time Geoff reaches 60, his growth assets are down to 57.7% and his income has gone up to 42.5%.

Reducing the proportion in shares as you age reduces the effect of market downturns while keeping you invested in some growth assets for the longer-term returns that can be achieved.

Find out what the mix of income and growth assets at your age (and different ages) here.

What if I don't want an age-related strategy?

You can pick your own strategy from the 40 investment options available. Information on SuperLife’s 40 investment options, and the returns, can be found here. Then it would be over to you to change your investment strategy as you age and manage the mix of growth and income assets.

If you wish to change your strategy you can do that online or by filling out a change strategy form.

Fund updates

Fund updates on all our investment funds are published each quarter on SuperLife’s website at: www.superlife.co.nz/legal-doc.

They give you information on how each fund has performed, the risk indicator, and the fees charged. The update is prepared in accordance with the Financial Markets Conduct Act 2013 and is designed to help you compare different investment funds.

Until now estimates have been used to calculate the other management and administration charges. In future, the fund updates will show the fixed amount published providing certainty and clarity for members.

SuperLife Managed Funds name change

In March, the names of the SuperLife Managed Funds will change. This change will make it easier for members to identify and compare the type of fund they are in, and better aligns with industry naming convention.

The funds will be referred to as the SuperLife Diversified funds to reflect their diversification across asset classes.

The new names will appear on your statements and online in March. Please note this is a name change only - there will be no change to any of the funds’ investment objectives.

| SuperLife30 | SuperLife Conservative |

| SuperLife60 | SuperLife Balanced |

| SuperLife80 | SuperLife Growth |

| SuperLife High Growth | SuperLife High Growth |

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/legal-doc