Quarterly News

To 30 September 2019

Welcome

Welcome to the December quarter news.

I am delighted to let you know that Smartshares has exceeded $4 billion funds under management (FUM) for the first time. That’s a 35%, or $1 billion-plus increase over the past year. Smartshares provides the investment options for SuperLife members through its low fee Exchange Traded Funds (ETFs), superannuation and KiwiSaver funds.

This growth has come from a combination of strong returns for investors and inflows to the ETFs, and the SuperLife superannuation and KiwiSaver schemes. This is a win for SuperLife members and the best possible advertisement for the broad range of low cost, index-tracking funds available to you through your membership of one or more of the SuperLife schemes. Find out more here.

Given the strong performance of markets, SuperLife fund returns were positive across the board over the year to December 2019. Highlights were the SuperLife Balanced fund returning 14.8% and SuperLife High Growth returning 21.1% (after tax and fees) for the year.

Global share markets ended the year in stellar form as US-China trade tensions eased and monetary policy stimulus started having a positive impact on some key global leading economic indicators. Some strength in the NZD towards the end of the quarter took some of the gloss off returns in global shares for unhedged investors. On the flipside, the gradual easing in geopolitical concerns and improving outlook for global growth resulted in meagre returns for fixed income investors during the quarter.

See how your own investment strategy has performed:

In “Thoughts on investment strategy”, our view is the global economic outlook should gradually improve in 2020, despite short term impacts from coronavirus and politics in New Zealand, the US and Europe. This will be aided by easing geopolitical concerns with a trade deal between the US and China in place, and the UK and Europe agreeing an exit plan for the UK to leave the European Union.

Also in this edition:

Get more information on SuperLife’s investment options and returns

Market Update

Global share markets ended the year in stellar form as US-China trade tensions eased and monetary policy stimulus started having a positive impact on some key global leading economic indicators. Some strength in the NZD towards the end of the quarter took some of the gloss off returns in global shares for unhedged investors. On the flipside, the gradual easing in geopolitical concerns and improving outlook for global growth resulted in meagre returns for fixed income investors during the quarter.

Both the Federal Reserve in the US and the RBNZ backed away from further easing, suggesting that enough had been done for now and further evidence of economic weakness would be required to cut rates further. Global growth is far from out of the woods, even though there have been signs of improvements. The US ISM manufacturing index showed that manufacturing activity continues to contract in the region, although the services index within the same survey remained strong, as did employment. China’s business activity slipped in December after expanding throughout most of the year.

Improving expectations of a trade deal between the US and China also lifted the outlook for global economic growth and had the biggest influence on share markets during the quarter. While we doubt this is the end of the stand-off between the world’s two largest economies, the deal removes prospect of companies having to pay higher tariffs into 2020. Interestingly, the US National Bureau of Economic Research released a working paper showing that US tariffs have been passed on entirely to US importers and consumers.

The NZ share market continued its unabated trend due to low interest rates. NZ shares remain relatively attractive exhibiting defensive characteristics amid a turbulent geopolitical environment. Arguably, stocks appear quite expensive but with easy monetary policy the hurdle rate for investment is low and earnings growth sustainable. The fourth quarter showed a lift in NZ house prices further unpinning household sentiment and consumption.

International equities

International developed markets increased by around 2.1% over the quarter, lifting the annual return to 31 December toward 27.8% (FTSE Developed All Cap Index in NZ dollar terms). NZD hedged equity returns were up 8.9% in the fourth quarter and 28.5% over one year.

Emerging markets

Despite ongoing trade tensions between the US and China, emerging market equities were up 4.4% in the quarter (FTSE Emerging Markets All Cap Index), with an annual return around 20.6% to the end of the December quarter.

Trans-Tasman equities

Easier monetary policy and global demand for higher yielding assets lifted NZ and Australian shares. The S&P/ASX 200 Index was up 0.7% in the third quarter and is now up 23.4% in the 12 months to 31 December. The S&P/NZX 50 Index was up 5.2% during the quarter and showing a stellar 30.4% over the 12-month period.

Bonds

Global bonds have delivered -0.6% this quarter and are up 7.6% in the 12 months to the end of December (Bloomberg Barclays Global Corporate Bond Index NZD hedged). NZ investment grade bonds returned -1.1% for the quarter and around 5.3% for the year.

SuperLife Funds

Given the strong performance of markets, SuperLife fund returns were positive across the board in both the quarter and over the year to December 2019. SuperLife Income, which has no exposure to equities, had a negative return of around -0.4% over the quarter and 5.1% over the year (all figures in this paragraph are after fees and tax at the highest rate).

The SuperLife Balanced fund returned around 1.7% in the quarter and 14.8% over the year, while the SuperLife High Growth fund, which largely invests in equities and property stocks, increased 3.2% in the quarter and 21.1% over the year.

SuperLife Ethica, which invests into funds that have strict sustainability criteria, also performed well, returning 2.7% over the quarter and 18.2% over the year to December 2019.

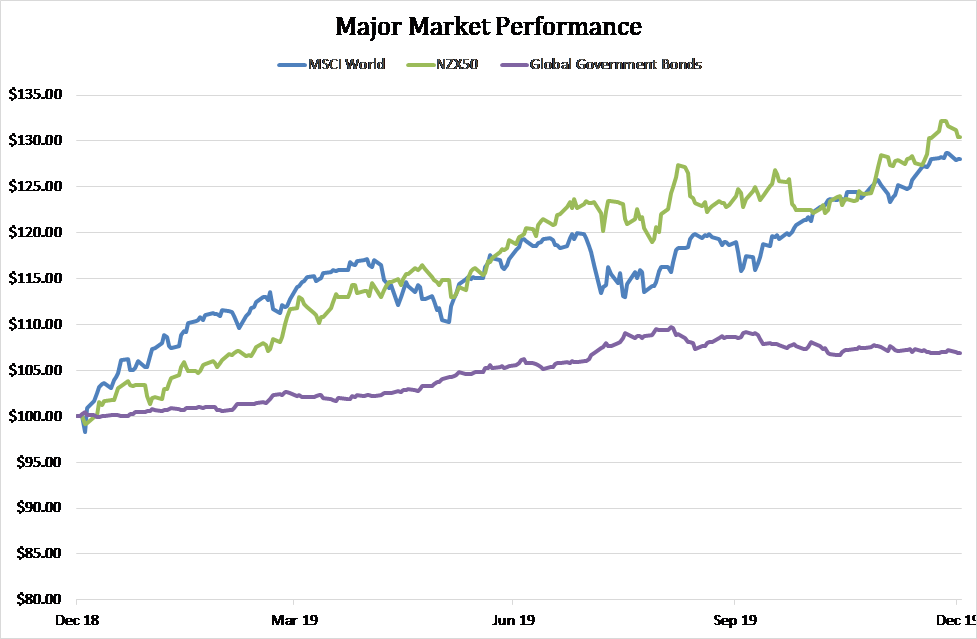

Figure 1 Major markets 12 months to December

In our view, the global economic outlook should gradually improve in 2020, despite short term impacts from coronavirus and politics in New Zealand, the US and Europe. This will be aided by easing geopolitical concerns with a trade deal between the US and China in place and the UK and Europe agreeing an exit plan for the UK to leave the European Union. Capital spending and business confidence weakened throughout 2019 as a result of these uncertainties and a reversal in this trend will be helpful going forward.

The second half of 2019 was strongly positive for risky asset classes, particularly NZ and other developed market equities. The negative sentiment resulting from US-China trade negotiations that weighed on global economic growth and the returns in these markets has now been priced out, meaning returns in 2020 will be lower than they were in 2019. As evidence unfolds and proves that companies can grow returns around the expected pace of global economic growth, we should see a period of stability in equity markets.

The returns on cash and bonds will be low in 2020 with central banks committed to supporting this outlook for growth.

On the proviso that global economic growth resumes, as we expect, developed market equities will outperform cash and bonds. That said, the hurdle to outperform cash and bonds is low and recent geopolitical events show that we should expect some volatility this year. Investors with some risk tolerance may see relatively good opportunities in emerging market equities and bonds where valuations are more attractive.

We are also starting to see evidence that the easing in monetary policy in NZ and other parts of the world is having a positive influence on economic growth. Increased borrowing and spending will support house prices and consumption.

However, there is no doubt the geopolitical risks will persist through 2020 and the assassination of Iran’s major general Qasem Soleimani early this year has ignited fears of renewed Middle East tensions. This also has implications for relations between the US and North Korea, with Trump showing that he can only be pushed so far, but at the same time supports North Korea’s pursuit of nuclear deterrents.

Our research shows that geopolitical events can have negative implications for risky asset classes such as shares and a positive influence on safe assets such as fixed income and cash, particularly in the short-term. However, in most scenarios share markets recovered most of their losses within six months showing that shifting out of risky asset classes in times of uncertainty can detract from longer-term returns.

The recent development of the coronavirus is causing unease in financial markets and being weighed up by economists. While it has the potential to negatively impact China and globally if it is not contained, previous events such as SARS have not tended to have a lasting impact on financial markets in aggregate. Some companies will suffer significantly, and markets will bounce around, but longer-term capital market assumptions remain unchanged.

This strategy does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer-term may not pay off over the very short-term. No one can consistently predict what’ll happen over the short-term.

Managing your SuperLife Managed Income

SuperLife’s managed income lets you set up a regular withdrawal, of an amount you choose, to be paid to your bank account, on a regular basis. The balance of your savings can continue to be invested with SuperLife.

If you are a KiwiSaver member, you can set up withdrawals from age 65. If you are a SuperLife Invest member, you can set up withdrawals whenever you like. For members in workplace savings arrangements, it will depend on your employer’s rules.

You can change your managed income at any time (up or down or stop). You also have the flexibility to take out a lump sum at any time and for any reason. This way you can spend your savings when you need to. Learn more here.

If you are making regular withdrawals, there are some things to think about, especially if you have a My Mix investment strategy in place, i.e. you have chosen your own mix of investment funds.

-

Reinvesting your investment return into the NZ Cash Fund

-

Regular withdrawal rebalancing

-

reduce the risk of withdrawing money from funds that invest in shares and property at a time when the value of those funds has fallen; and/or

-

maintain a minimum level of cash and/or fixed interest.

Each fund receives income (e.g. interest and dividends) as part of its overall investment return. Our standard practice is to automatically reinvest the income into the fund it came from. However, another option is to invest the income into the NZ Cash Fund; this may be a better option if you are making regular withdrawals from SuperLife. In simple terms, you would be topping up your cash bucket using the returns from your other investment options. If you want to change to this option, you can change it online or by emailing This email address is being protected from spambots. You need JavaScript enabled to view it..

Over time, market movements will change the proportions of your investments so that they differ from the proportions you set in your My Mix investment strategy.

Regular withdrawal rebalancing is designed for investors that want to:

If you choose this option, we will regularly rebalance your investments (normally each month) to maintain the proportions set in your investment strategy; however, we will only rebalance by moving money from higher volatility funds (e.g. funds that invest in shares and property) to lower volatility funds (e.g. funds that invest in fixed interest and cash), and will not move money the other way.

If you decide to change your rebalancing option you can change it online or by emailing This email address is being protected from spambots. You need JavaScript enabled to view it..

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/legal-doc.

What’s your goal for 2020 and beyond?

The start of a new year is a good time to take stock of your financial health, and set some goals for the coming year, and beyond. Those goals may be short-term, such as start a rainy day fund for emergencies, or mid-term for example saving for a first home, or longer term saving for retirement. The Sorted website has some good tools to help with that. Try the goal planner tool that gives you a step by step process to look at goals, then further tools to help such as the KiwiSaver savings calculator.

A starting point could be to review your SuperLife accounts. Here are some things you could do.

-

Start your "rainy day" fund

-

Check your KiwiSaver contribution rate

-

Check if you are saving enough to get your maximum government contribution

-

Review your investment strategy

-

Review your insurances

-

Consider saving for children

-

Review your beneficiaries

You can save a little over time to build up your rainy day fund for those unexpected emergencies by opening a SuperLife Invest account. With a SuperLife Invest account you can withdraw the funds when you need to (usually one business day’s notice) by simply completing a form. You can open a SuperLife Invest account online or by This email address is being protected from spambots. You need JavaScript enabled to view it..

Did you know that if you are an employee, you can now choose to contribute 3%, 4%, 6%, 8% or 10% of your pay to your KiwiSaver account?

If your goal is to save for your first home or the longer term goal of increasing your retirement savings, you could consider increasing your contribution rate. You can change your contribution rate once every three months, unless your employer agrees to a shorter timeframe. You can change the rate by telling your employer in writing or by completing a KiwiSaver deduction form (KS2).

If you are not an employee, you decide how much you save. If you decide to change you can change it online or by completing a Contribution change form

For every $2 you save in your KiwiSaver account, the government contributes $1 up to a maximum of $521 for a full year to each June. If you save $20 a week or $87 a month you will save enough to get the maximum. Click here for more details on the government contribution.

It’s a good idea to check if your investment strategy is still the appropriate one for you. Your investment strategy is a major contributor to the returns you will receive from your investments and should, therefore, be designed to meet your financial goals. It also depends on your situation - in particular, how you feel about risk and volatility (ups and downs in the value of your investments), when you plan to spend the funds and what you might use them for (e.g. retirement or for a first home deposit). To learn more about this, read our Investment Guide.

The Sorted website also includes an investor kick-start page to help you think about what type of investor you are.

If you decide to change your strategy you can change it online or by completing the change investment strategy form.

If you have a financial adviser, SuperLife has available a free-of-charge facility enabling you to agree a reasonable fee with your financial adviser and have it deducted from your SuperLife account. For a list of financial advisers signed up in your region, please This email address is being protected from spambots. You need JavaScript enabled to view it..

You can work out what your insurance needs might be using SuperLife’s article “how much insurance do I need?”. Find out more on SuperLife’s insurance options.

A SuperLife Invest myFutureFund account lets you put aside some savings for children, to cover costs such as back-to-school costs or starting further study. It’s designed with flexibility in mind so that anyone can save towards a child’s future. A nominated guardian makes all the decisions about contributions, choosing investment options and withdrawing investments until the child reaches age 25. Find out more here. You can set up a child’s account online or by completing the form in the SuperLife Invest product disclosure statement.

Under SuperLife, we must pay the benefit to the people you have nominated. Note that under KiwiSaver, the benefit is paid to your estate – another good reason to have a will. You can update your beneficiaries online or by completing the update beneficiaries form.

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/resources/legal-documents