Quarterly News

To 31 March 2018

Welcome

Welcome to SuperLife’s quarterly news. I’m Hugh Stevens and I joined the team in February. These updates are designed to keep you informed about what is happening at SuperLife and how our team can help you. We hope you find the format of this news clear and the content interesting. We welcome your feedback on information you would like to read here. If you have any questions, please contact the SuperLife team.

This quarter we provide an update on market activity, in particular recent volatility in global equity markets after a strong performance in 2017. You can view each of our funds and their performance by following the link below, or log in to the website to see how your investment strategy has performed. As always, we also provide the My Future Strategy update.

Finally, if you have been thinking about saving or investing in addition to your KiwiSaver or company scheme, I encourage you to read our spotlight on SuperLife Invest below.

Hugh Stevens

CEO, Smartshares

Market Update

The following comments are written by Aaron Drew, Principal, MyFiduciary

Global equity markets moderately sold-off in the first quarter of 2018. This followed a very strong performance in the year ended 2017. Markets experience ups and downs, and therefore do not move in a straight line. If they did, the healthy extra return that is earned relative to cash by holding equities and bonds over the long-term could hardly be expected.

Amongst the pack, Australian equities fared the worst returning around -8.0% for the quarter in New Zealand dollar (NZD) terms. Around half of this decline was due to a strengthening of the NZD against the Australian dollar (AUD); the decline was around -4% in AUD terms. Overseas shares also declined around 4% in NZD terms, though again our surging currency detracted from performance. In foreign currency terms the decline was much more modest at around -1.3% (as measured by the MSCI World Index). In contrast to the developed equity market performance, emerging market equities were resilient falling by only around 1% in NZD terms and increasing by around 1.4% in local currency terms (as measured by the MSCI Emerging Market Index). This result is at odds with the common view that emerging markets are riskier than developed markets, and hence sell-off more strongly in times of market stress. Their resilience likely reflects that the global economic environment remains quite robust, with agencies such as the OECD increasing their expectations of global growth for 2018 and 2019 despite the recent market volatility. The New Zealand equity market also fared reasonably well, though this was mainly due to the stellar performance of The A2 Milk Company.

Bond returns were soft for the quarter and year. SuperLife Workplace Savings scheme’s NZ bond fund returned around 0.6% for the quarter, whilst overseas bonds were broadly flat for the year (net of taxes, cost and fees). This result reflected that a key catalyst for the March sell-off was the Federal Reserve in the United States re-affirming the need it sees to tighten monetary policy. Consequently, forward interest rates rose ahead of what markets were expecting, eroding bond returns and the returns from bond like investments such as listed property. We should not, however, expect interest rate rises to have ongoing negative consequences for asset prices – rising interest rates are a sign that the global economy continues to heal from the global finance crisis, and historically equity markets have fared well, despite rising rates, when accompanied by a solid economic and corporate earnings environment. This is the environment that is still expected by most economic commentators and agencies despite the emergence of new risks such as escalating trade tensions between the United States and China.

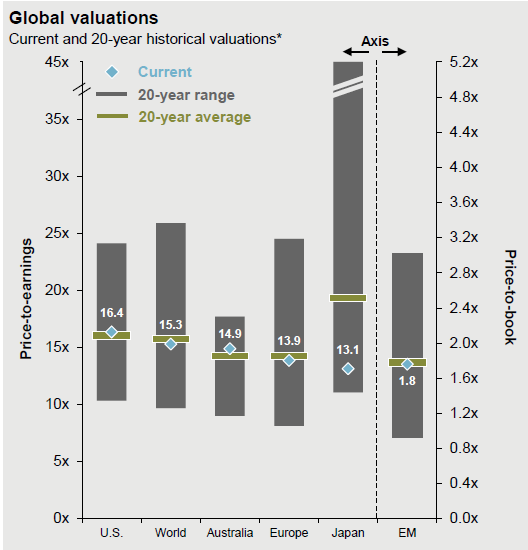

The silver lining to the recent decline in markets is that valuations are now more compelling. The chart to the right shows price-to-earnings and price-to-book multiples for global equities are back to around long-term average levels. This common yard stick of equity market valuations suggests that markets in general are not over-valued, and hence from a valuation stand-point there is no reason to expect that markets must correct further from present levels.

Information on SuperLife’s 41 investment options and the returns can be found here.

My Future Strategy

The following comments are written by Aaron Drew, Principal, MyFiduciary

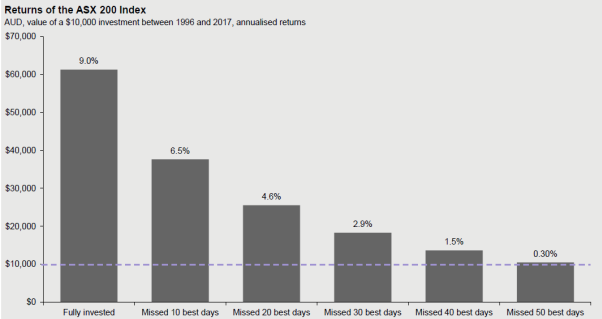

For an investor with long-term horizons staying the course with your present investment strategy is usually the best option, subject to your goals, objectives and cash needs remaining broadly the same as when your strategy was established. Numerous studies show that being out of the market can be very corrosive to long-term wealth accumulation. To provide an illustration, the chart below shows that investors in the Australian market who missed the best 10 days over the past two decades reduced returns by 2.5% per annum, whilst investors who missed the best 50 failed to earn a return at all. In addition, studies also suggest that these outsized returns often occur around market sell-offs. Investors who try and time markets by getting out after a sell-off hence may miss the best returns markets offer.

Source: FactSet, MSCI, Standard and Poor’s, JP Morgan Asset Management

For investors with short-term cash needs, or who have taken more risk than they are normally comfortable with, the run up in markets over recent years presents an opportune time to increase cash holdings (the correction in 2018 is still quite modest in this respect).

For investors who have concern with performance over a medium-term horizon (next three to five years or so) there may be an opportunity to enhance returns by tweaking your longer-term allocation to cash, bonds, equities and property stocks as follows:

- Holding less in bonds, and therefore more cash and shares. This reflects the view that interest rates may still increase more quickly than is currently factored into bond prices given the strength of global growth and employment conditions, and the potential for this to increase inflation faster than expected.

- Favouring non-government (corporate) bonds over government bonds, given the risk of faster interest rate increases is more material for government bonds.

- Favouring value, emerging market, Australian and European stocks compared to US stocks. These markets are broadly assessed to offer more value than US stocks

- Maintaining holdings of property stocks and New Zealand stocks at around your long-term allocation

- Reducing the currency hedge on overseas shares to below your long-term allocation given the large run up in the NZD over the previous six months or so

The above strategy does not take account of an individual’s personal situation. As with all investment decisions, what might be the right strategy over the medium term, may not be right over the very short term. We really don’t know what will happen over the short term.

Review your SuperLife account

- Check your prescribed investor rate (PIR) here. You can change your PIR online or by contacting the SuperLife team.

- Find out how to make sure you receive your maximum annual government KiwiSaver contribution of up to $521 here. If you need to save more, you can now set up a KiwiSaver lump sum payment online simply by logging in here.

- NZ Super rates increased on 1 April 2018. Get the new rates here.

SuperLife Invest

SuperLife Invest is our most flexible investment and savings option. You decide how much you invest, when you invest and when to make a withdrawal (which we will generally process within one business day). This means your savings are not locked in until retirement.

You can keep it simple by choosing a managed fund to suit your risk profile, or by building your own investment strategy from over 40 investment options.

By choosing SuperLife invest for your savings or investments, you can keep track of it all in one place alongside your KiwiSaver or workplace savings – either online, on our app, or via your regular statements.

It’s easy to join online or you can learn more by emailing This email address is being protected from spambots. You need JavaScript enabled to view it. or calling 0800 27 87 37.