Quarterly News

To 31 March 2020

Welcome

Welcome to the March quarter news.The last three months have been a roller coaster ride for the global financial markets.

The S&P 500 index has seen both its largest monthly fall, and largest monthly rise since the 1930’s depression. It has been a stressful time for many SuperLife members. We have been very busy with calls, emails, chats, and web seminars to answer questions, provide reassurance and share our views.

Thankfully, some calm has returned recently but global markets will remain very volatile. This newsletter includes some tips on how to deal with this volatility. If your circumstances have not changed, we recommend sticking to your long-term investment strategy through the ups and downs.

In line with the volatile global markets, SuperLife funds saw returns fall in the March quarter. We expect conditions to stay difficult. There is, however, comfort in the co-ordinated fiscal and monetary stimulus between central banks and their governments to keep economic activities going.

We take pride in that when you call, you will be speaking directly with a knowledgeable member of our team. Continue to reach out to us. We are here to help.

Enjoy the read.

Hugh Stevens

CEO, Smartshares

In 'Thoughts on investment strategy', our chief investment officer Stuart Millar tells us why he thinks that post-lockdown, some sectors will shine, particular technology-driven companies, those companies with strong governance, and ethical companies with sustainability as a way of life. Bonds and fixed income performance may be uninteresting as they will have to endure the impact of central banks flooding the financial system with cheap money to keep the economic engines going.

Also in this edition:

- Check your prescribed investor rate (PIR)

- Recent KiwiSaver changes

- Holding onto your KiwiSaver goals

Get more information on SuperLife’s investment options and returns

Market Update

Global share markets have had a roller coaster ride during the first quarter of 2020. After a few weeks of volatility, some calm has resumed in the global markets. The week prior to Good Friday, the S&P 500 has clawed back losses and retraced to August 2019 levels after major volatility. The S&P 500 also saw its biggest one-week gain of 12.1% seen since 1974 during that week.

What has underpinned global markets is the strong and unanimous support central banks around the world are giving their governments. Central banks are backing governments’ fiscal rescue packages by making sure there is money supply available for banks to continue lending at low interest rates to support businesses.

The key geopolitical concern of a full-scale trade war between China and the US trade has taken a backseat as their leaders focus on tackling healthcare issues posed by Covid-19.

Threats of the global crude oil market imploding due to uncertainties over disputes between two major oil producers Saudi Arabia and Russia, have also subsided as OPEC, an organisation of major oil producers, has on April 12, 2020 announced plans to cut production by 9.7 million barrels per day or 10% of global production. Oil markets, however, remain volatile due to oversupply concerns.

Global share markets went through a volatile first quarter amid the Covid-19 pandemic. The S&P 500, which tracks 500 of the largest US companies, fell to its lowest level of 2,237.40 on March 23, also the lowest since the global financial crisis (GFC).

The S&P 500 has since recouped most of the losses and is sitting near pre-Covid-19 levels.

Equity funds suffered significant losses in the first quarter of 2020 across all geographies. SuperLife investment returns reflected the market’s movements during the first quarter.

International equities

Returns from international shares, after accounting for currency fluctuations, fell 12.3% in the March quarter. Returns were up 0.5% over 12 months. (FTSE Developed All Cap Index in NZ dollar terms)

NZ equities

NZ equity returns fell 14.8% during the March quarter in line with major losses experienced around the globe. Over 12 months, NZ equity fell 0.5% (S&P/NZX 50)

Emerging markets

Emerging markets has had its share of scares, led by fears the trade scuffles between China and the US could turn into a full-scale trade war. However, both governments have had to focus on their domestic health crisis posed by Covid-19.

In the March quarter, emerging market returns fell 14.9% and over 12 months, returns were down 7.1%. (FTSE Emerging Markets All Cap, in NZ dollars)

Trans-Tasman equities

Australian equities returns fell 23.1% in the March quarter, reflecting the nervous sell-offs seen across world markets. Over 12 months, Australian equities fell 14.4%. (S&P ASX 200 Total Return Index)

International fixed interest/bonds

Returns from overseas bonds rose 1.4% in the March quarter but over 12 months, returns rose 6%. (Bloomberg Barclays Global Corporate Bond Index NZD hedged)

NZ bonds returned 1.3% in the March quarter, 4.2% over 12months. (S&P/NZX A-Grade Corporate Bond Index)

SuperLife Funds

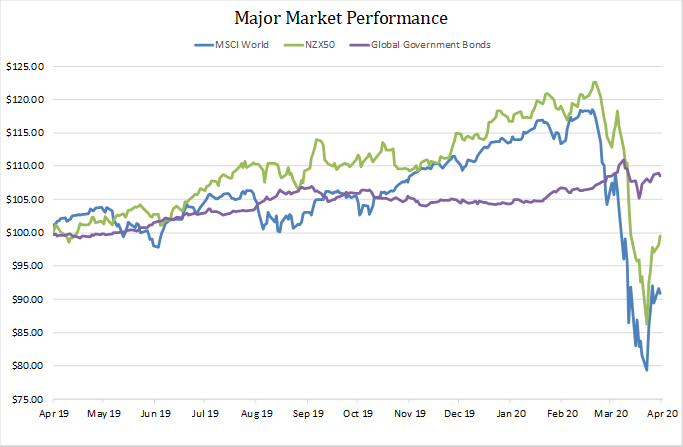

Fund returns fell in line with a tough first quarter experienced globally as the Covid-19 pandemic caused extreme volatility in the month of March. Up until Covid-19, markets were still experiencing strong rallies in the US and in NZ.

SuperLife Income which does not have any exposure to equities, had a negative return of 1.01% in the March quarter as markets were concerned over falling yields against a backdrop of central banks’ monetary stimulus. Returns were up 1.83% over 12 months.

SuperLife Conservative, invested mainly in income assets, saw returns fall 7.18% in the March quarter. Over 12 months, returns fell 2.58%.

SuperLife Ethica, which invests into funds that have strict sustainability criteria, saw returns fall 12.34% in the March quarter; over 12 months returns fell 3.72%.

The SuperLife Balanced Fund (which typically has 60% in equities/listed properties and 40% in cash and fixed income) saw returns fall 12.41% in the March quarter. Returns were down 6.12% over 12 months.

SuperLife Growth saw returns fall 16.27% in the March quarter. Over 12 months, returns were down 9.18%. The fund invests mostly in international equities, some cash and fixed interest.

SuperLife High Growth which invests mostly in higher risk assets such as equities and property stocks, saw returns dipped 19.82% in the March quarter. Returns fell 12.01% over 12 months.

Figure 1: World, NZ and global government bonds, April 2019 to April 2020

Source: Bloomberg/SuperLife

The far-reaching threats of a global pandemic has given investors a scary awakening. As recent as February this year, we were still experiencing record highs in the local stockmarket. Rumblings in Wuhan’s Covid-19 outbreak were largely ignored by markets, even after China locked down the city to contain the outbreak.

It wasn’t until the European countries started experiencing the impact of Covid-19 that financial markets reacted. Within the blink of an eye, the US market went from euphoria to panic. The US market wiped off three years of gain in one week. The S&P 500 dropped 34% to a low of 2,237.40 on Mar 23 after a peak of 3,393 on Feb 19. Since then, it has bounced back around 27%.

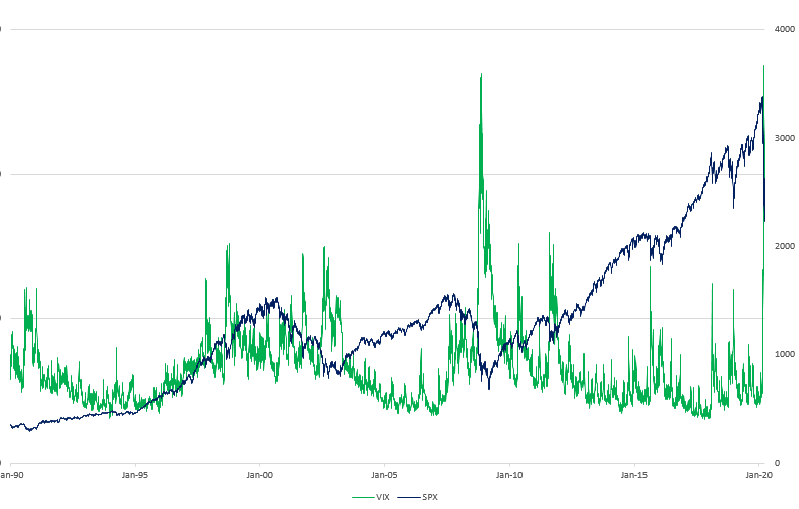

At times like this, it’s useful to take a look what the market’s behaviour tells us. The indicators we use to gauge investor sentiment show there was a high degree of fear amongst investors. The Chicago Board Options Exchange Volatility Index (popularly known as VIX or the ‘Fear Index’) reflects the volatility implied in options pricing. In March, the ‘fear index’ reached some of the highest levels on record, and did this in the shortest timeframe ever.

The aggressive selling reflects a high degree of fear, similar to those seen during the GFC in 2007/2008. Markets have recovered some ground. However, we should expect large price swings (both up and down) to persist as markets assess the likely severity of the recession that will accompany Covid-19 and how long it will take for the economy to recover.

That will largely depend on how long lockdowns need to remain in place to contain the virus. We can gain some comfort from the co-ordinated efforts by central banks around the world to provide monetary stimulus and stabilise financial markets. This, in addition to massive fiscal stimulus governments are providing, are the actions needed to help economies recover when lockdown measures are eased. Both equity and bond markets responded favourably to news of these government actions.

Figure 2: A picture of fear-led selling on the S&P 500

Source: Bloomberg/SuperLife

Our government has made its single largest peace-time financial aid of over $20 billion, one of the largest amounts spent on each person compared with any country in the world.

The US Federal Reserve also announced aggressive plans to buy corporate bonds and make direct loans to companies through a US$2-trillion stimulus package. The UK has a US$39 billion economic stimulus in the pipeline while other nations are doing the same.

However, it will be between 6 and 12 months, at least, before global economies make any meaningful clawbacks to the growth levels seen before Covid-19 struck. The other unknown is how much central banks and governments can afford to continue supporting their economic stimulus programmes.

The downside of these actions is that we will see low returns on cash and bonds, and possibly negative real returns (after factoring in inflation) if policy makers are successful in their efforts to mitigate the economic impact and avoid inflation. However, these asset classes remain a safe place to invest for conservative investors or those with short-term investment horizons.

Spreads between corporate bonds and government bonds will likely remain wide for a time while investors remain fearful about the economic impacts of the lockdowns.

High quality corporate bonds could produce some attractive medium-term returns, especially those unfairly sold in the en-mass flight to safety. Many of these companies have strong balance sheets, with sound debt management practices. The SuperLife NZ Bond Fund is heavily geared towards these issuers.

In the riskier equities asset class, healthcare and technology sectors will do well for as long as the health threat from Covid-19 and social distancing remains in place. Should the lockdowns prove successful, and government and central bank measures result in a rapid recovery, then some of the most severely affected companies could perform strongly from oversold levels.

Lockdowns across the world has given the world a glimpse of weird and wonderful ways in which technologies can overcome the limitations of physical barriers. Technology companies have helped people to work, connect and shop. Companies with applied and tested technologies in these areas will be attractive, and funds with exposure to these sectors will benefit.

In a challenging economic environment, equities investors will be looking for companies with sustainable growth strategies and good governance. ESG-screened equity index funds are tilted towards companies that rank well on these measures, and we have seen these funds perform relatively well through this sort of turbulence. (ESG refers to environmental, social and governance investing.)

Our Ethica Fund is a balanced (60% growth and 40% income) strategy with sustainability overlays. Other ESG-screened regional equity exposures are currently only available through Smartshares exchange traded funds (ETFs). However, we do have plans to make these available on the SuperLife platform in the future. The Automation and Robotics and the Healthcare Innovation ETFs are also available through Smartshares.

It is incredibly difficult to generate short-term gains by switching in and out of funds. Many of the investors who switched out of risker equity investments as fears mounted did so at, or near the lows. Almost none put money back to work at the right time either.

The best strategy is often to invest more when others are fearful, and effectively accumulate assets at attractive prices. In our view, maintaining a balanced investment strategy and continuing to invest when assets are trading at a discount is the best way to achieve your investment goals over time.

What’s important is making sure your investment strategy meets your own return objectives and risk tolerance. Our managed funds and age-steps models are diversified and designed to cater to different age groups, what their risk profiles are, and when their retirement investments will likely be cashed out. If you are unsure of where you fit, find out here.

This strategy does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium- or longer-term may not pay off over the very short term. No one can consistently predict what will happen over the short term.

Check your prescribed investor rate (PIR)

At this time of the year you should check your PIR rate. Your PIR can be 10.5%, 17.5% or 28% depending on your taxable income. More details on PIR, including a calculator to check your PIR, are available here.

It makes sense to check your PIR is correct because Inland Revenue can now identify all income including wage and salary and investments and will be able to work out what rate you should be on. From 1 April 2020, if Inland Revenue assess that you are on the wrong PIR, they can instruct SuperLife to change it. If you then think the rate should be different, you can also instruct SuperLife to change it and we are required to do so.

To change your PIR:

- Do it online

- Email This email address is being protected from spambots. You need JavaScript enabled to view it. and include 1) your name 2) birth date 3) SuperLife member number or your IRD number

- Fill out a PIR advice form and send it to us

- Call 0800 27 87 37 to get a form.

Recent KiwiSaver changes

Recent changes to KiwiSaver laws allow Inland Revenue to pay your employer’s KiwiSaver contribution into your KiwiSaver account even before your employer pays them to Inland Revenue. This means your KiwiSaver contributions will start earning investment returns sooner.

Other changes in KiwiSaver include:

- When you switch to the SuperLife KiwiSaver scheme from another KiwiSaver provider, they have to send your fund’s information to SuperLife within 10 working days (previously 35 working days). This means your savings are with your chosen scheme sooner.

- You can now change your contribution rate by contacting SuperLife, or Inland Revenue as well as through your employer.

Holding onto your KiwiSaver goals

Investors have just witnessed some really hair-raising moments as financial markets fell on news of the health crisis caused by Covid-19.

As global markets dived in March, KiwiSaver members reacted. KiwiSaver members have reportedly moved around $1 billion into conservative funds and cash, out of higher risk funds (aggressive, growth and balanced). Morningstar’s data covers 90% of funds under management. Source: Investment News

It is highly tempting to try to protect investments against falls. However, history has shown that even professionals fare rather poorly when they try to pick the market's lows.

This bad investment-timing decision was seen recently when the S&P 500, which tracks price movements in large US companies, had within a 3-month period recouped nearly 50% of lost grounds (between February 19 and mid-April). The NZX 50 saw its lowest point on March 23 but by mid-April, it has recouped nearly 20% of its losses.

Tips for KiwiSaver members responding to market volatility

It is useful to take note that your KiwiSaver investments have been designed to smooth out volatilities experienced by markets such as Covid-19 or the GFC.

KiwiSaver funds are made up of different types of assets based on when you are likely to withdraw your funds, and your risk profile.

Maintain perspective: KiwiSaver is a retirement savings scheme, which means you generally can’t access it until you reach 65.

Stay with your investment goals: Your KiwiSaver balance will rise and fall over time. Switching in and out of funds may result in further losses, and investors who try to time the markets haven’t historically been successful.

Get advice: If you need to change or reset your investment goals and portfolio because your circumstances have changed, talk to an authorised adviser. If you don’t have one, contact us and we will recommend one.

Fear of losing everything: For your investment balance to go to zero, every single company and asset in your portfolio would have to fail. That is not going to happen. Your savings is invested in a range of investments in different types of companies, bonds and fixed income, including cash. This diversification reduces the funds’ risk.

Read this Sorted article on why you should not be switching funds because your balance is dropping.

Suspend your KiwiSaver contributions: You can suspend your savings for between 3 and 12 months if you have been a KiwiSaver member for at least 12 months. Remember you will also miss out on some or all of your employer’s portion if you choose to suspend contributions. Non-employed people can stop their contributions anytime.

Resist temptation to withdraw. Read Retirement Commissioner Jane Wrightson’s take on withdrawing from KiwiSaver.

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/resources/legal-documents