Welcome

Economies around the world have been finding their way out of the disruption of the COVID-19 pandemic. There is a fresh sense of hope, and a sense of normality beginning to take shape.

Global vaccination roll-outs have given markets much reason to cheer. Despite the economic recovery taking shape, the International Monetary Fund has cautioned that growth across the world remains unequal, and incomplete.

The next few months will be challenging and volatile as the world adjusts to the economic recovery and the side effects, including the possibility of rising inflation.

You will find good historical numbers in annual returns across most funds but it is useful to note the markets have been recovering from very low levels seen in March 2020.

At SuperLife, we help some 75,000 members with their investment needs. When markets are uncertain, the cost factor becomes important. We are proud to be known as one of the lowest cost providers in the country.

From time to time, you might come across news about responsible investing and its different facets. You might already know this, but it is worth noting that investment consultant MyFiduciary has picked our Ethica fund as one of the few socially responsible KiwiSaver funds that has a broad policy for excluding unethical activities, and also seeks out companies that are focused on creating positive long-term outcomes.

We also offer funds whose investment objectives are to track an underlying index without any screening. These offer cost-effective access to the underlying asset classes and geographies.

If you are keen to learn more, check out our Ethica fund. We are happy to help answer any questions you have by email at This email address is being protected from spambots. You need JavaScript enabled to view it. or call us at 0800 27 87 37.

In ‘Thoughts on investment strategy’, our chief investment officer, Stuart Millar is of the view that investors will be shifting their focus towards cyclical stocks that will benefit from an improving economic environment, and sectors of the market such as property and infrastructure that can also shield investors from an unexpected rise in inflation.

Enjoy the read.

Hugh Stevens

CEO, Smartshares

Follow these links to:

Market Update

The first three months of 2021 offered a sense of hope for a potential future free from the shackles of COVID-19 as governments around the world raced to roll out vaccination programmes.

Over 1.16 billion doses of vaccine have been administered across 174 countries (according to Bloomberg, as at 4 May, 2021). At the current rate of vaccination, the world is only expected to achieve full immunity in a number of years, it said.

The vaccination roll-out has given markets reasons to cheer. The relatively upbeat prognosis given by the International Monetary Fund (IMF), which raised its forecast for global growth to 6% in 2021 against the 5.5% forecast made in January this year, also lifted the market’s mood.

The economies of the US and China will recover to a level of economic growth that will surpass the levels they saw before the pandemic hit just over a year ago, according to the IMF.

Despite the economic forecast revision and the recovery taking shape, the IMF cautioned that growth across the world has been unequal, and incomplete.

US ramps up stimulus programme

The strong resolve by the US to lift itself out of economic doldrums has been the main fuel for global optimism. The Federal Reserve is stoic on its position to keep money supply ample while President Joe Biden is aggressively pushing through new fiscal stimulus efforts.

In March this year, Biden signed the enactment of the American Rescue Plan Act of 2021, which is a US$1.9-trillion rescue package designed to lift the US economy from the devastating impact caused by the COVID-19 pandemic. In April, he announced a US$2-trillion initiative to overhaul America’s infrastructure which he termed ‘a once-in-a-generation investment’ in America. These stimulus packages are on top of the Coronavirus Aid, Relief, and Economic Security Act (or the CARES Act) of just over US$2 trillion, passed in 2020.

Equities stay in the limelight

Equities continued to hog the limelight during the first quarter, buoyed by positive economic recovery data. The S&P 500 Index, which tracks 500 of the largest US companies, rose 53.7% in the 12 months to 31 March 2021. During the first quarter of 2021, the S&P 500 gained 5.7%.

Large technology stocks dominated gains in 2020. However, smaller-sized stocks have been making significant advances in recent months, reflected in the Russell 2000 Index gaining 92.5% in the 12 months to 31 March 2021, and 12.4% during the first quarter.

The NZX 50 Index, the bellwether for our top 50 largest companies, rose 28.2% in the 12 months to 31 March 2021, but fell 4.1% during the March quarter.

The era of cheaper money means bonds and fixed-interest investments continued to languish despite slight rumblings of an earlier-than-expected change in US monetary policy stance.

The benchmark 10-year US government bond yields have been through some volatile trading, dipping to a low of 0.5% on 4 April 2020 before scaling a high of 1.7% on 31 March 2021.

International equities

In the March quarter, international shares, converted to NZ, returned 8.4%. Over 12 months, returns were 34.5% (FTSE Developed All Cap Index NZD).

NZ equities

NZ equities returns, as measured by the S&P/NZX 50 Gross Index, fell 4.1% in the quarter. Over 12 months, NZ equities returned 28.2% (S&P/NZX 50 Gross Index).

Australian equities

Australian equities, as measured by the S&P/ASX200 Total Returns Index, returned 4.3% in the quarter. Over 12 months, Australian equities returned 37.5% (S&P ASX 200 Total Return Index).

Emerging markets

Emerging markets returned 3.1% in the quarter and 57.1% over the year (FTSE Emerging Markets All Cap).

International fixed interest/bonds

Overseas bond returns fell 2.5% in the quarter but over 12 months they returned 1.4% (Bloomberg Barclays Global Aggregate Total Return Index, NZD hedged).

NZ bonds

NZ bond returns fell 2.1% in the quarter but over 12months they returned 1.9% (S&P/NZX A-Grade Corporate Bond Index).

SuperLife funds

SuperLife Income, which does not have any exposure to equities, saw returns drop 1.7% in the March quarter. Over 12 months the fund returned 3.4%.

SuperLife Conservative, invested mainly in income assets, returned 0.2% in the quarter, and 12.8% over 12 months.

SuperLife Balanced (which typically has 60% in equities/listed property and 40% in cash and fixed income) returned 2.3% in the quarter and 23.5% over 12 months.

SuperLife Growth returned 3.7% in the quarter and 30.4% over 12 months.

SuperLife High Growth, invested mostly in higher risk assets such as equities and property stocks, returned 5.1% in the quarter and 38% over 12 months.

Ethica, a socially responsible diversified fund, returned 2.3% in the quarter and 28% over 12 months.

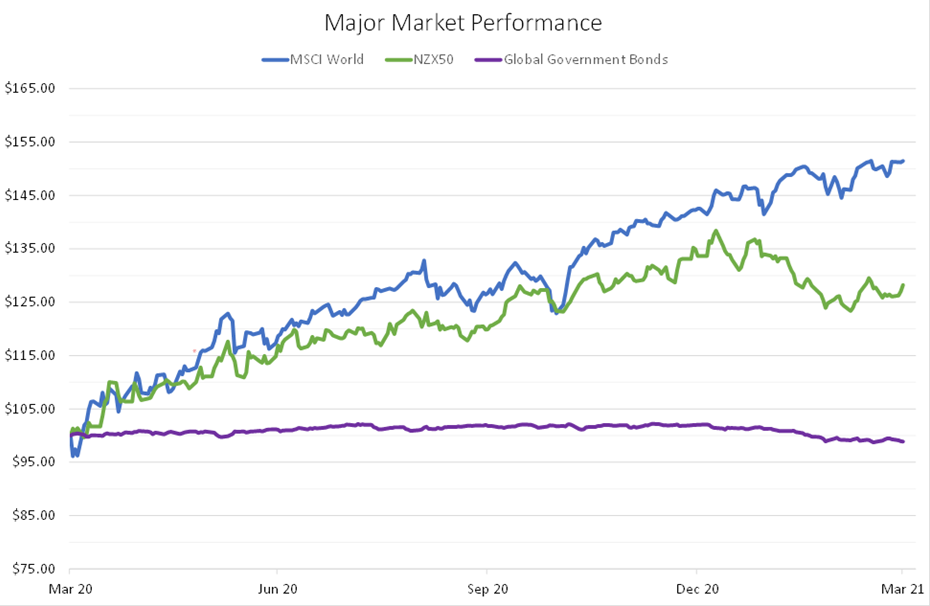

Figure 1: Bonds hibernate, world equities continue recovery

Source: Bloomberg/SuperLife

One of the biggest deciding factors in the coming months for the investment world is whether inflation — likened to the multi-headed Hydra for the different economic pains it can inflict — will be stronger than what the market expects.

A fear of rising inflation has been creeping back into markets as global economies begin their recovery journey. This fear has been reflected in the movement of the US-10 year government bond yields which have been through see-saw trades.

What remains uncertain is whether the US economic recovery will see a full-scale rebound or whether some sectors will be left behind. What will also be important is whether global economic recovery is widespread or limited to some countries.

What does all this mean for investors?

The next few months will be challenging and volatile as the world adjusts to the recovery and the side effects, including supply issues caused by pent-up demand, and the possibility of price pressures and how this could affect inflation.

As governments ramp up their vaccination programmes to contain the COVID-19 pandemic, all eyes will be on the efficacy of the vaccines, and the response to the reported side effects. There will also be concerns about new COVID-19 variants potentially derailing a full-scale global recovery.

- Since the sell-offs seen in March 2020, equities have seen a dramatic turnaround, back to pre-pandemic levels, and in the US historic highs have been reached.

- Returns for most of SuperLife’s funds have been strong over the last 12 months. This is because financial markets have been recovering from very low levels seen in March 2020. However, investors should note that past returns are not a reflection of what the future returns will be.

- Price-to-earnings ratios (a key indicator of a company’s price relative to its performance and prospect) have been on the rise. Going ahead, it will be challenging to find value among equities. Investors will be looking for companies with strong earning potential, but also those with reasonable valuation.

- Big tech stocks which have led the market’s rise might be under pressure as attention turns to stocks whose prospects are tied to the economy’s recovery.

- Defensive companies, or companies whose fortunes are relatively immune to economic fluctuations, are also likely to continue to be in focus.

- In an environment facing inflationary pressures, investors typically seek out asset classes that can provide a hedge against any erosion in their assets’ value. Commodities, property and infrastructure will be closely watched. Fixed-income assets such as cash and bonds remain traditional safe havens when markets become volatile.

- Bond yields have made advances in recent months and will be closely watched. The recent rise in yields implies the market has been pricing in expectations of higher inflation as the economy recovers. What remains uncertain is whether central banks, including the US Federal Reserve, will adjust their earlier commitments to keep interest rates unchanged to support economic recovery.

- As the US first quarter earnings reporting season kicks in, investors will be focused on whether companies will exceed expectations or disappoint.

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

The SuperLife Age Steps option lets you set your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you are concerned about your investments, or would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.