Quarterly News

To 30 September 2019

Welcome

Welcome to the September quarter news.

I am pleased to report that in our recent customer satisfaction survey, half of respondents gave us a 9 or 10 out of 10 when asked how likely they’d be to recommend us. A further 36% scored us 7 or 8 out of 10. We’re delighted with the results and have noted suggestions from members on how we can do better. We appreciate the feedback and thank all who responded.

One of the comments in the survey was about wanting to speak to a real person – not just email. We totally agree and we have a friendly and knowledgeable team ready to assist. Just call 0800 27 87 37 to talk to one of the team.

This quarter the market commentary and our new section “Thoughts on investment strategy” are provided by Smartshares’ Chief Investment Officer, Stuart Millar, who is responsible for overseeing the investment of all funds managed by Smartshares Limited.

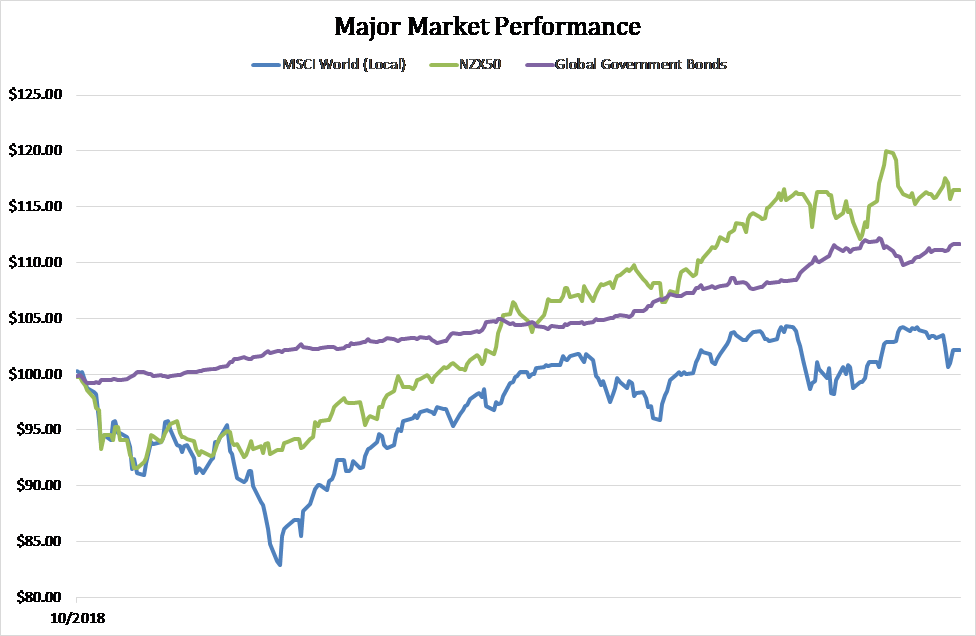

This quarter proved turbulent for both equity and bond markets but despite this ended on a positive note. Global property was the strongest performing asset class with falling bond yields driving demand for equities paying high dividends and stable cash-flows. Global equity returns for unhedged NZ-based investors were strongly positive as well, helped by the falling NZ dollar as economic concerns edged up.

See how your own investment strategy has performed:

In “Thoughts on investment strategy”, we note that the strong returns we have seen in the 12 months to date, despite the escalation in trade tensions and fears of recession, are a stark reminder that it is “time in the markets” rather than “timing the markets” that helps us achieve our long-term investment objectives.

Also in this edition:

- “Funds for Everyone”- the Financial Markets Authority (FMA) guide to investing

- SuperLife’s five Diversified Funds

- How KiwiSaver can help you get into your first home

Get more information on SuperLife’s investment options and returns

Market Update

This quarter the market commentary and investment strategy thoughts are provided by Smartshares’ Chief Investment Officer, Stuart Millar, who is responsible for overseeing the investment of all funds managed by Smartshares Limited.

Market commentary

This quarter proved turbulent for both equity and bond markets but despite this ended on a positive note. Global property was the strongest performing asset class with falling bond yields driving demand for equities paying high dividends and stable cash-flows. Global equity returns for unhedged NZ-based investors were strongly positive as well, helped by the falling NZ dollar as economic concerns edged up. The Reserve Bank of New Zealand surprised markets with a 50bp rate cut in an attempt to spur economic growth. Together with the global demand for yield, this assisted local equities and property.

Global economic growth has been pressured by intensifying trade tensions and an increase in tariffs between the US and China. Global multi-national companies had been holding out for a trade agreement that would relieve them of the need to re-arrange supply chains. However, that was not the case and business sentiment globally has continued to deteriorate.

This resulted in action from the US Federal Reserve, where Chairman Jerome Powell has cut interest rates on two separate occasions this year. The Bank of China also responded by lowering the reserves required to be held by banks and allowed the Yuan to depreciate to assist exporters. We are yet to see substantial fiscal stimulus from the Chinese government but do suspect that this will be required if trade tensions continue to weaken economic growth.

As a small open economy, New Zealand is sensitive to worsening global economic conditions and business confidence has continued to weaken. The surprise move by the Reserve Bank to cut rates as much as they did may have created even more fear among business owners. However, the Reserve Bank does not have any more information than what is already publicly available.

International equities

International developed markets increased by around 7.0% over the quarter, lifting the annual return to 30 September 2019 toward 5.8% (FTSE Developed All Cap Index in NZ dollar terms). NZD-hedged equity returns were less attractive but were up 0.8% in the third quarter and over one year.

Emerging markets

Despite ongoing trade tensions between the US and China, emerging market equities were up 2.6% in the quarter (FTSE Emerging Markets All Cap Index), with an annual return around 6.3% to the end of the September quarter.

Trans-Tasman equities

Easier monetary policy and global demand for higher yielding assets lifted New Zealand and Australian shares. The S&P/ASX 200 Index was up 3.1% in the third quarter and is now up 12.1% in the 12 months to 30 September 2019. The S&P/NZX 50 Index was up 4.6% during the quarter, showing a stellar 17.2% over the 12-month period.

Bonds

Global bonds continue to defy low return expectations and have delivered 2.6% this quarter and are up 10.0% in the 12-months to 30 September 2019 (Bloomberg Barclays Global Corporate Bond Index NZD hedged). New Zealand investment grade bonds returned 2.2% for the quarter and around 7.8% for the year.

SuperLife Funds

Given the strong performance of markets, Superlife Fund returns were positive across the board in both the quarter and over the year to 30 September 2019. SuperLife Income, which has no exposure to equities, had a positive return of around 1.5% over the quarter and 6.0% over the year (all figures in this paragraph are after fees and tax at the highest rate).

The SuperLife Balanced fund returned around 2.4% in the quarter and 6.1% over the year, while the SuperLife High Growth fund, which largely invests in equities and property stocks, increased 2.7% in the quarter and 5.3% over the year.

SuperLife Ethica, which invests into funds with strict sustainability criteria, also performed well, returning 3.4% over the quarter and 7.3% over the year to 30 September 2019.

The strong returns we have seen in the 12 months to date, despite the escalation in trade tensions and fears of recession, are a stark reminder that it is “time in the markets” rather than “timing the markets” that helps us achieve our long-term investment objectives.

Investors who stuck with their investment strategies through the volatility in the fourth quarter last year will now be a step closer to achieving their long-term investment goals, having accumulated assets at a discount throughout this period.

Market corrections will occur from time to time and knowing exactly when to exit the market is almost impossible. A portfolio that combines both equities and bonds will complement each other through cycles and help smooth the bumps and dips in your portfolio returns over time.

That said, and depending on your individual willingness and ability to take risk, it is possible to adjust your investment strategy to best position your portfolio based on your outlook for various asset classes. Here are a few ideas to consider.

- If trade tensions and global economic growth persist, then a more conservative fund that holds more cash and bonds than shares and listed property will likely outperform.

- NZ equities have shown defensive characteristics relative to global equities when trade concerns were a key source of concern for markets. If a resolution for trade between the US and China is made, then global equities and emerging market equities could do better than local markets.

- If global growth and uncertainty remains high, then the return on cash and bonds could be quite low but stable going forward. As long as global growth does not falter then corporate bonds and listed property are asset classes that can deliver a higher return with less sensitivity to global growth than broader equities.

- The fall in bond yields has also resulted in strong returns in fixed interest and cash. High yielding markets such as corporate bonds and listed property have also performed well. If bond yields start to move higher again, then these markets could underperform equities.

These thoughts on investment strategy do not constitute financial advice and do not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer-term may not pay off over the very short-term. No one can consistently predict what’ll happen over the short-term.

“Funds for Everyone” – the Financial Markets Authority (FMA) guide to investing

The Financial Markets Authority has published “Funds for Everyone” – a guide to choosing, buying and monitoring managed funds and exchange traded funds (ETFs).

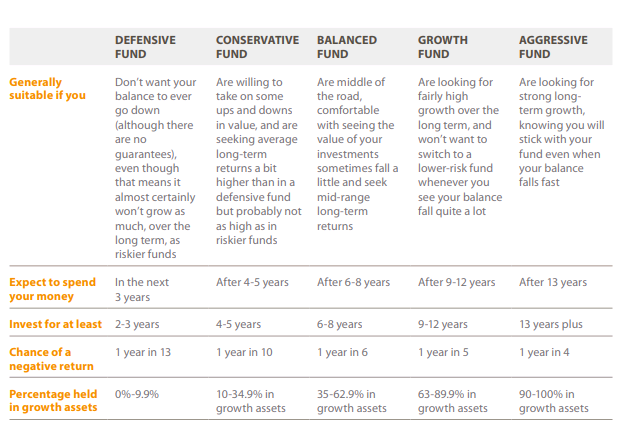

The guide starts by saying that the first step to investing is to identify your investment goals, timeline, strategy and investor type, including the level of risk you are willing to take. It tells you what to think about when starting to invest including how to work out what fund is right for you and how managed funds work.

It says, “Managed funds are a popular choice for investors who don’t want to spend a lot of time managing their investments. They allow you to outsource parts – or all – of your portfolio to a suitably qualified expert who pools individual investments into a larger investment fund and manages that money. You can select a fund that matches the level of risk you’re comfortable with, or invests in the type of assets you’re interested in.”

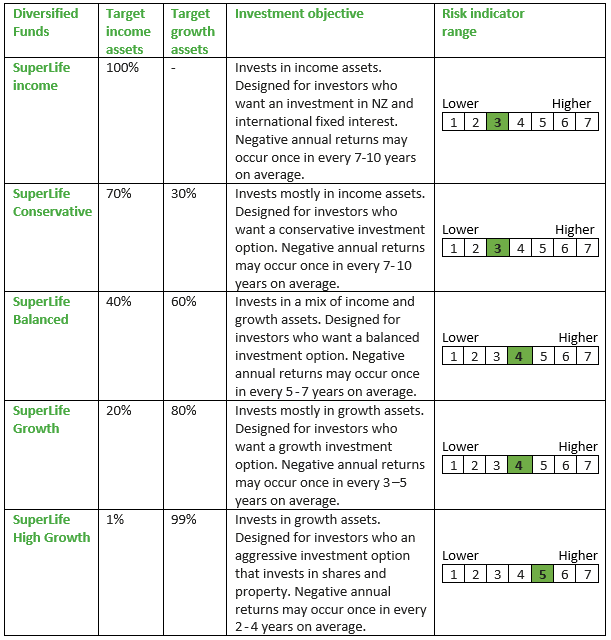

SuperLife has five managed funds called Diversified Funds, listed below. They invest in a mix of income assets (cash/fixed interest) and growth assets (shares/property). You will see that as the percentage of growth assets (shares/property) increases, so too does the risk indicator and the potential for higher returns.

You can get more information on SuperLife’s Diversified Funds, and other investment options, at www.superlife.co.nz.

The “Funds for Everyone” guide also gives a broad picture of what type of funds suit different people (see extract below). You can also use the Sorted Investor Kickstarter tool to work out what kind of investor you are.

How KiwiSaver can help you get into your first home

Being in KiwiSaver gives you two opportunities to access funds towards your first home purchase. One is the First Home Withdrawal where you can apply to your KiwiSaver provider to make a withdrawal from your KiwiSaver account towards your deposit. See the rules below.

The second is the First Home Grant which provides additional funds between $3,000 and $5,000 for an existing house, and between $6,000 and $10,000 for a new home. Couples can both qualify if they meet the criteria. See the rules below.

First Home Withdrawal rules

- If you have not owned land or a house before, by yourself or with someone else, you may qualify to take money out of KiwiSaver when you buy your first home.

- If you have owned a house before, you may still qualify, if Kāinga Ora – Homes and Communities considers that your financial situation (in terms of your income, assets and liabilities) is the same as what would be expected for a person who has not owned a home. In this case, you need Kāinga Ora – Homes and Communities to certify this.

- You must have not made a withdrawal from KiwiSaver for this purpose before.

- You need to have been a member of a KiwiSaver scheme or a complying superannuation fund for at least 3 years (note, the 3 years is the membership period and not the savings period).

- You must be buying the house in New Zealand.

- The house you are purchasing must be intended to be your principal place of residence.

- You can withdraw for the purchase of an interest in a dwelling house on Maori land that is intended to be the principal place of residence for you, or for you and your family, if evidence of the right to occupy Maori land is provided.

- You can use the first home withdrawal to make payments as part of the purchase price, including deposit payments, before the agreement for sale and purchase is unconditional, but has to be refunded to your KiwiSaver account if the sale does not proceed.

- If you are eligible to make a withdrawal, you can withdraw everything in your KiwiSaver Account except for $1,000. This means you can withdraw all of your savings, the contributions made by your employer, the government contributions and all of the investment earnings.

- Being able to access the employer contributions and government contributions is a significant boost to the money available to help buy your first home.

To apply for the First Home Withdrawal you need to complete the First Home Withdrawal form and send it to This email address is being protected from spambots. You need JavaScript enabled to view it..

First Home Grant rules

- The First Home Grant is separate from the First Home Withdrawal. It is managed by Kāinga Ora – Homes and Communities (the new agency that includes Housing New Zealand and KiwiBuild).

- To qualify, you must have been saving in a KiwiSaver scheme, or a complying superannuation fund, or exempt employer scheme for at least 3 years and your savings must have been at least 3% of your taxable pay. For non-working people, the savings have to have been at least 3% of the minimum adult wage based on a 40-hour week.

- Couples can both qualify jointly. In fact, up to three people can apply for a First Home Grant for the joint purchase of a house.

- To purchase an existing house, the First Home Grant is $1,000 for each year you have saved in a KiwiSaver scheme, or a complying superannuation scheme, or exempt employer scheme, with a maximum of $5,000.

- For the purchase of a new home, the First Home Grant is $2,000 for each year you have saved in a KiwiSaver scheme, or a complying superannuation scheme, or exempt employer scheme, with a maximum of $10,000. The maximum applies after 5 or more years’ savings. The 5 years’ saving do not need to be consecutive. Where two people apply together, both can qualify for the maximum.

- You must be 18 or older and must have a deposit, which can include your KiwiSaver balance, at least 5% of the value of the house you are buying.

- You must agree to live in your new house for at least 6 months.

- The value of the house must be within the regional house price caps – details here.

- In the 12 months before you apply, you must have earned:

- $85,000 or less before tax for a single buyer

- $130,000 or less before tax for 2 or more buyers.

- If you are buying land to build a house, or buying an apartment not yet built, the house/apartment must be built within the timeframes stated in the building contract. You must be able to show the availability of the necessary funding required to build the house/apartment.

- It is possible to get pre-approved eligibility, if this is necessary to help secure a mortgage.

To apply for a First Home Grant, you need to contact Kāinga Ora – Homes and Communities on 0508 935 266 or at kaingaora.govt.nz/home-ownership/first-home-grant. You will also find other useful home ownership information there.

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/resources/legal-documents