Money Month Tips

August 2024

Author: Cameron Watson,

Head of Investor Education at Smartshares

What's your personal top tip for someone just starting their financial journey?

My top tip is to do three things: start early, invest regularly into a balanced portfolio and invest for the long term so compounding can work its magic.

Markets can be volatile, they move up and down. Investing a lump sum means you invest at a point in time, exposing you to what is called ‘market-timing risk’ – the risk that the market falls not long after you invest. People who invest in regular instalments over time can actually benefit from market volatility. If the market falls, they may be able to invest at lower prices, thus reducing their average purchase price. Investing regularly on autopilot is a great way to build up savings without having to lift a finger, and it also removes the emotion from your investment decisions – which is usually a good thing.

The benefit of starting early is that you will be investing for a longer time, and time is the fuel for arguably the most powerful force in investing, compounding.

Compounding is the process of earning returns on returns. If you invest $1,000 and earn a return of 5% your portfolio will grow by $50 and the value of your investment at the end of the year will be $1,050. Over the second year, if your portfolio again gains 5% your return will be $52.50. The return is higher by $2.50 because you earn the return not only on your original $1,000 but also on the $50 you earned last year (5% on $50 is $2.50). The power of compounding becomes more obvious over the long term. After 10 years the original investment would be worth $1,629, after 20 years $2,653.

Regular savers can benefit from compounding. Someone who can save $200 a month ($2,400 a year) for 30 years will invest $72,000 and, using an illustrative annual return of 5% (after tax and fees), their end value would be $163,075. This means over half (56%) of their end value would have come from compounded returns.

It was with good reason that Albert Einstein once called compounding “the eighth wonder of the world”.

Calculations use the Superlife savings calculator. Please note, the 5% return is used here for illustrative purposes only. It is not an indicator of future returns.

What's surprised you the most about your own financial journey?

I am always surprised by how many surprises markets spring on us as investors. Whether it is a sea change in the fortunes for our local market or overseas markets, a sharp increase (or fall) in interest rates or a new emerging technology that sets markets alight, there is always something unexpected happening. It has highlighted to me the importance of having a diversified portfolio both within, and across, different asset classes and markets.

When it comes to money, what keeps you up at night?

Hopefully, your investments shouldn’t keep you up at night. There is a golden rule of investing called “the sleep test” which says your portfolio should have a mix of low and higher risk assets which aligns with your tolerance for risk. While it has a feel good factor – who needs extra stress in their lives – there is also a serious angle to this maxim.

Having a balanced mix of assets means people are more likely to be able to ride out declines in markets and not sell out after markets have fallen. This locks-in their loss and can mean they miss the inevitable rebound in markets. As well, having some of the portfolio invested in growth assets, like shares, helps mitigate our concerns that our savings will not grow adequately over the long term.

Inflation is a key risk we should all be aware of. I call it “the invisible risk” as it eats away at the purchasing power of our savings, often without us noticing. According to the Reserve Bank’s inflation calculator, over the 24 years since the start of this century (from December 1999 to June 2024), the compound average annual rate of inflation has been 2.6%. This has reduced the buying power of $1.00 by 46% to just 54 cents over this period. In other words, goods and services that cost $1.00 in December 1999 now cost $1.86.

Growth assets, like shares and property, are regarded as providing the best protection against inflation over the long term.

This information is issued by Smartshares Limited, a wholly owned subsidiary of NZX Limited. Smartshares Limited is the issuer and manager of the SuperLife KiwiSaver Scheme, SuperLife Workplace Savings Scheme, SuperLife UK Pension Transfer Scheme, SuperLife Superannuation Master Trust and SuperLife Invest. The product disclosure statements are available at superlife.co.nz/legal. Level 15, 45 Queen Street, Auckland Central 1010 PO Box 105262, Auckland City 1143 Past performance is not a reliable guide to future performance. The calculations and returns used in this article are illustrative and intended as a guide only, and are not an indicator of future returns. The value of investments can go down as well as up and investors may not get back the full amount invested nor any particular rate of return referred to in this article. Returns are not guaranteed. This information is intended to provide a general guide and is based upon, and derived from sources Smartshares Limited considers reliable. Neither Smartshares Limited nor NZX Limited, or their respective directors and employees accept any liability for any errors, omissions, negligent misstatements, or for the results of any actions taken, or not taken in reliance on this information. This information is not a substitute for professional advice. In preparing this information Smartshares Limited did not take into account the investment objectives, financial situation or particular needs of any particular person. Accordingly, before making any investment decision, Smartshares Limited recommends professional assistance from a licensed Financial Advice Provider is sought

Customer Survey Prize Draw Terms & Conditions

Entry

- By entering this Prize-Draw, entrants agree to be bound by these terms and conditions and acknowledge the Smartshares Privacy Policy https://smartshares.co.nz/privacy-policy. Information on how to enter this Prize-Draw forms part of these terms and conditions.

- Only Eligible Persons can enter this Prize-Draw. To be an Eligible Person, you must have completed our Customer Survey before 11:59pm on 24 October 2023.

- Staff of Smartshares Limited and their immediate families are not eligible to enter this Prize-Draw.

The Prize Draw

- There will be one draw in the Prize-Draw. The winner of the Prize-Draw will be drawn at random from a pool of all Eligible Persons on 30 November 2023 (Draw Date).

- The first Eligible Person whose name is drawn will be the Prize Winner.

- The prize will be one $1,000 Prezzy® Card (Prize).

- The Prize Winner will be contacted by Smartshares using the email address that Smartshares has for the Prize Winner.

- If Smartshares is unable to contact the Prize Winner after a period of four weeks following the Draw Date, having made reasonable efforts to do so, that person’s entry will be declared invalid and the Prize will be re-drawn.

- The Prize Winner agrees to publication of their name, as the Prize Winner.

General

- Smartshares reserves the right to disqualify any entrant for tampering with the entry process or attempting to act in a fraudulent or otherwise dishonest manner, and to disqualify any entry in the Prize-Draw in its sole discretion without giving reasons.

- The Prize will be couriered to the Prize Winner within 21 days of confirming the delivery address of the Prize Winner.

- By using the Prezzy Card, the Prize Winner agrees to the terms and conditions, and the card fees set out at www.prezzycard.co.nz. The Prize Winner should refer to www.prezzycard.co.nz/terms-conditions for detailed Prezzy Card terms and conditions, including, but not limited to, their use and expiry.

- The Prize is not exchangeable or negotiable. However, if the Prize Winner does not wish to claim their Prize, they may nominate another person to whom their Prize can be transferred. If it is transferred, the Prize must not be sold or used, donated or given away as part of another promotion.

- Smartshares will not be liable for any loss, claim, cost, expense, liability or injury (Loss) suffered by any participant in any way associated with the competition including as a result of entry into the competition or winning the Prize, except where such Loss cannot be excluded by law.

- These terms and conditions are governed by and construed in accordance with the laws of New Zealand and are subject to the exclusive jurisdiction of New Zealand courts.

- This competition is run by Smartshares Limited NZBN 9429038512483.

March 2021 Quarterly News

Quarterly News

To 31 March 2021

SuperLife offers the ideal workplace savings solution. Benefits include:

- You set the rules - SuperLife lets you tailor the rules around contributions and benefits, so that you can create a plan designed for your business. It's more than just superannuation; we can add other benefits to your plan like KiwiSaver, insurance and voluntary savings.

- Seamlessly integrated - we take care of the administration (such as contributions and payments) and ensure that you and your employees receive regular information, including market updates.

- Flexibility - through SuperLife, your employees can choose from a broad range of passive, low cost investment options to tailor a solution for their needs.

Choose an employee benefits provider that puts its members interests first.

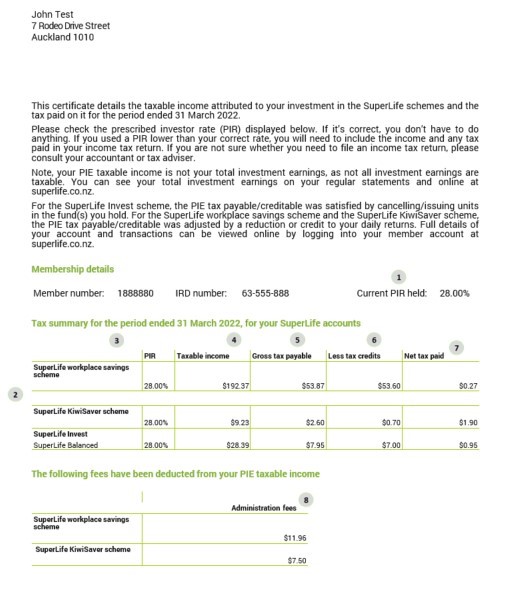

Understanding your annual tax certificate

|

1. Current PIR held This refers to the current PIR we have on record for you.

2. SuperLife schemes The tax summary table covers every SuperLife scheme you are invested, except the SuperLife UK pension transfer scheme which is not a portfolio investment entity (PIE). Every fund in SuperLife Invest is detailed because each fund is a PIE. You can learn more about the schemes and funds by reading the relevant product disclosure statement found on superlife.co.nz.

3. PIR This shows the PIR we used to work out the tax on your investment income for each of your SuperLife schemes (except the SuperLife UK Pension scheme). Your PIR can be 0%, 10.5%, 17.5% or 28%. You don’t have to do anything if the PIR shown on the certificate is correct. You can work out your PIR here. For joint account holders, the higher PIR rate will be used to work out the tax on your investments.

4. Taxable income This refers to how much of your investment income is taxable. PIEs have special tax treatments so not all the income earned from your PIE investments is taxable. What is taxable depends on the type of assets held by your funds and schemes. Find out more here. Your taxable income is reported less any expenses available for deduction.

5. Gross tax payable This refers to how much tax you are paying on your investment income. The amount is worked out using this formula: Gross tax payable = PIR x taxable income The non-taxable part of your investment return, taxable investment return and the tax payable are shown on your regular member statements which are available online.

6. Tax credits A tax credit reduces the amount of tax that you pay. For example, if the fund you are in earns income from overseas investments for which tax has been paid, a tax credit may be available.

7. Net tax paid This figure is the total tax paid or total tax refunded to your account balance in a SuperLife scheme (except the SuperLife UK pension scheme). Your tax has already been paid on the taxable investment income so no action is needed when you receive this certificate. However, if you gave us the incorrect PIR, you may need to complete a tax return.

8. Administration fees The administration fee is $30 per year or $2.50 per month (if applicable) for KiwiSaver scheme members and $12 per year for the SuperLife Invest and SuperLife workplace savings scheme. |

|

Start Investing Now

Choose Superlife: a low fees KiwiSaver provider that will work for you today, and in the future.

For Employers

Smartshares

Why try to pick stocks when you can own the whole index? SuperLife lets you access many of Smartshares Exchange Traded Funds (ETFs).