Kia ora

Economies around the world, including New Zealand’s continue to go through a challenging time. The daily news cycle is full of stories of soaring food and energy prices and the natural reaction of those invested in the equities markets is to be concerned by any fall in the value of their investments.

Even though we know that risk is an inherent part of investing, it’s usually when the markets are turbulent that we take more notice. Despite the urge to react and sell when you see markets plunge, that may be the exact opposite of what should be done. A decrease in the value of your investments is only realised by selling or switching out of your investment. Until then, it is just a loss on paper. With markets at lower levels, this may also present a good opportunity to invest more as prices become more attractive.

A recent historical example, the Covid-related crash of March 2020, illustrates what may happen in markets. A sharp fall, followed by a recovery. Over the history of the S&P 500, for every fall, there has been a recovery although some recoveries take longer than others.

The current sentiment in global markets is expected to continue for at least the next 3 to 6 months, with periods of ups & downs along the way. Market traders will try to anticipate whether the U.S. economy will have a soft or hard landing, and whether the US Federal Reserve and other central banks will succeed in curbing inflation. This is a balancing act for the central banks around the world – if they go too far, they risk pushing their economies into a recession. It might take nerves of steel to ignore the ups and downs in the market, but it is important to make decisions based on your long-term investment timeframes rather than short-term market fluctuations.

At SuperLife, our investment team is continually looking at how we strategically manage your money in our diversified funds, and what adjustments are needed to add value. On your part, we encourage you to take time to review whether your investments are consistent with the amount of risk you can tolerate and your investment timeframe.

Making changes to your investment strategy or finding Information about your account balance can be easily accessed on the SuperLife mobile app, or our member portal if you have signed up for online access. We are here to help if you have any other questions. Email This email address is being protected from spambots. You need JavaScript enabled to view it. or call 0800 27 87 37 to speak to one of our customer service team members.

Enjoy the read!

Hugh Stevens

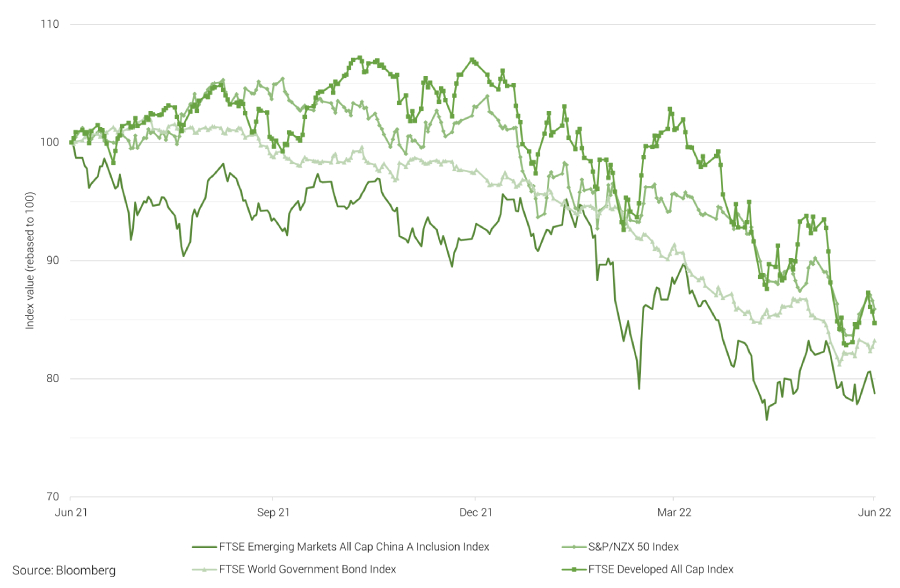

World indices at a glance: Longer-term bond yields turn north, equities head south

(Data source: Bloomberg, compiled by SuperLife)

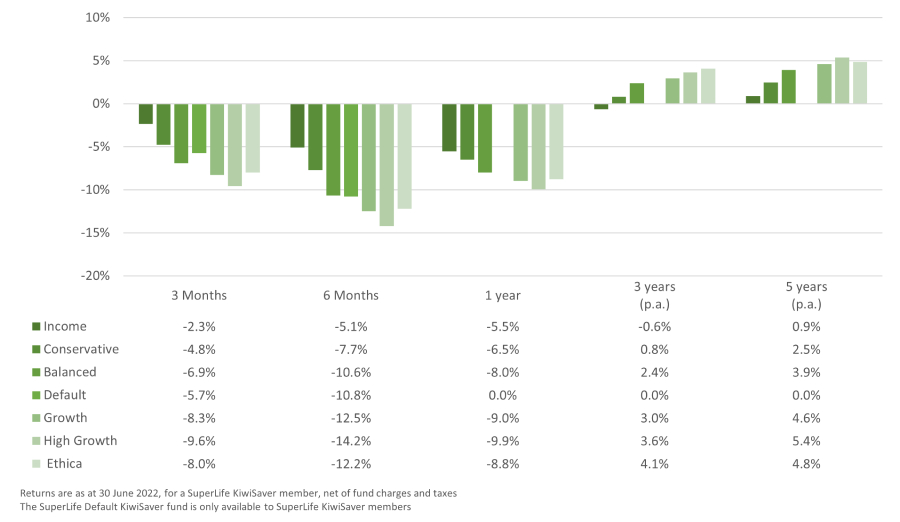

SuperLife Diversified Funds as at 30 June 2022

(Note: Past returns are not a reliable indicator of future performance)

Global assets: Rocky first half for global markets

Market update & outlook

The June quarter was out of the ordinary in that both bonds and equities delivered negative returns during the period. The NZ dollar declined against major market currencies, as well, which had a positive impact on portfolios invested in international assets.

Stocks sold off for a second consecutive quarter on concern that rising interest rates aimed at curtailing inflation would have a negative impact on earnings growth. Supply-chain disruptions and a protracted Russia-Ukraine war has seen consumer price inflation rise at the fastest pace since the 1980s.

Back then the U.S. Federal Reserve risked pushing the US economy into recession to stamp on inflation. Some investors fear a similar cycle may be repeated. However, we can take some comfort that central banks are better at dealing with inflation than they are with deflation.

If investors believe the central banks can stabilise inflation, they can become more certain about the price they should pay for assets. Unlike the experience seen in the 1980s, central banks and consumers know that central banks can deal with inflation, and they will be careful not to push the economy into recession.

While high inflation and rising interest rates are initially difficult for equities and bonds, the yields available to conservative investors on cash and bonds are now much more attractive than they have been for some time. The risk that interest rates rise substantially more than already expected is relatively low. As a guide, the NZ government bonds were yielding more than 4% towards the end of the quarter.

The Fed raised interest rate by 0.75% on 15 June, its largest hike since 1994. This brings the Fed fund rate (used as a benchmark for overnight bank funding costs) to between 1.5% and 1.75%.

In July, the Reserve Bank of New Zealand (RBNZ) increased its official cash by 50 basis points, to 2.50%.

How we look after your money

- One of the regular things we do is keep a close eye on the impact of changes in interest rates and economic trends. We then look to take actions in our diversified funds to optimise risk and return. Over the past 12 months, we reduced portfolio exposure to fixed interest to reduce the risk of higher-than-expected inflation and rising interest rates. We also reduced our exposure to Australasian and international equities, and increased investments in infrastructure funds which tend to perform better during periods of rising inflation. We also decreased our hedging levels which benefited portfolios as the NZD fell amidst rising economic uncertainty. As a result, value was added to investor returns relative to the status quo.

- SuperLife’s diversified funds are structured to have a mix of equities, bonds, and fixed income. For example, the SuperLife Balanced Fund has cash, fixed interest, equities, and listed property in its portfolio. This means a fall in one asset class is often cushioned by the rise or relative stability of another type of asset.

Ways to invest

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

With our SuperLife Age Steps option, we automatically set the proportion of your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or phone 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.