The New Zealand Government has appointed SuperLife as a default KiwiSaver provider and we have now transitioned more than 37,000 new members into the SuperLife KiwiSaver Default Fund. Welcome to our new members and a big thank you to all our customers who continue to support us.

During the quarter, New Zealand’s economy continued to be affected by the COVID pandemic. The world is also still coming to terms with the war between Russia and Ukraine. Behind the tremendous human suffering, one immediate economic impact was the leap in oil prices to highs we have not seen since 2008 and rising commodities prices. Higher input prices are driving consumer price inflation which we expect to put a dent in global economic growth.

Some of you have been asking about what’s been happening to your savings balances in light of these events and the resulting market volatility. We understand your concerns. We can reassure you that our highly experienced investment team, led by our Chief Investment Officer Stuart Millar, is constantly reviewing market conditions and how our investment strategies are working to manage risks for our customers.

After a number of ‘good’ years, it is easy to forget that markets don’t always move in a straight line. It’s also easy to see how volatility and uncertainty can tempt investors to act hastily or even irrationally. It’s natural to want to run for cover when you see markets tumble. But that’s not always the best action to take.

If you are saving for retirement, your investment timeframe is usually over many, many years. With your time horizon in mind, the daily rises and falls of markets are less important than being committed to your long-term goals, and knowing you are in the right fund, and how much risk you can tolerate. Get in touch if you need help choosing a fund and risk level that is right for you.

SuperLife’s diversified funds are built with market volatility in mind. For more information about how the funds invest I encourage you to take time to read our Product Disclosure Statements. They can help you make informed choices.

As always, please do not hesitate to get in touch if you need help with your account.

Enjoy the read!

Hugh Stevens

CEO, Smartshares

Thoughts on investment strategy

On war, Inflation, rising world oil prices

As the world continues to grapple with the long tail of the COVID pandemic, fears of increased market volatility and rising inflation have been keeping investors awake at night.

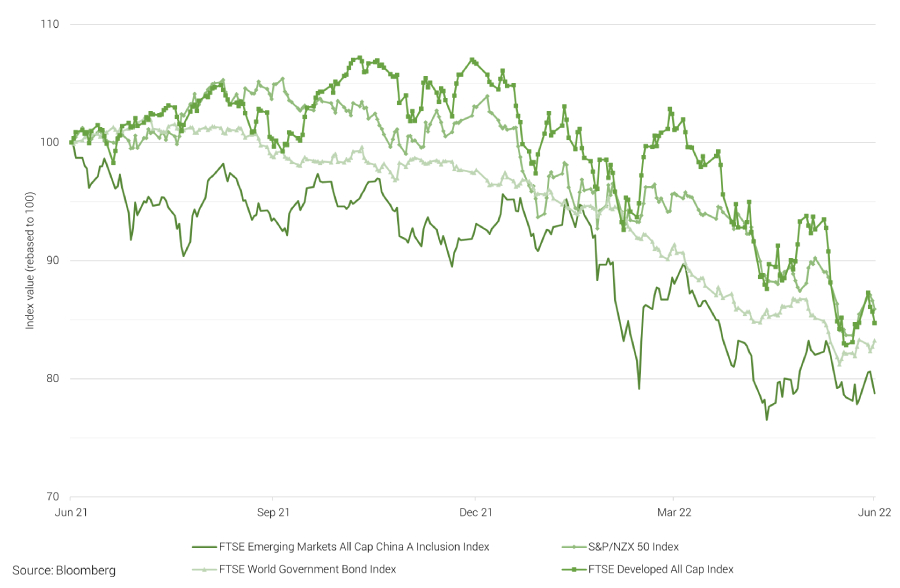

Equities which have had a spectacular run since 2020, are taking a backseat while sovereign assets such as US Treasuries and government bonds have come into the limelight.

Some headwinds faced by equities, bond yields rising

On war, Inflation, rising world oil prices

The Russia-Ukraine war has rocked financial and commodities markets around the world. A direct impact of the war is rising crude oil and commodity prices. Russia is the world’s third largest oil producer while Russia and Ukraine are both commodity producers.

Sanctions on Russia such as asset freezes, trade embargoes, and non-access for Russian banks to international system to clear bank transfers will continue to create uncertainties for the world. Over time however, stockmarkets have largely ignored wars and major shocks.

In our last update we talked about how inflation will be the driver behind how aggressive the Federal Reserve (the Fed operates like a central bank) will be when it raises interest rates. Given there are increasing signals that inflation is no longer a transitory event in the U.S., a rising concern is whether the Fed’s planned successive interest rate increases will throttle an economy still in recovery mode.

Analysts remain divided on how much the Fed will raise the Fed fund rate. Forecasts are for a hike of between 0.75% and 1.25% over the next nine months. The Fed’s meeting in December signalled there might be three rate hikes in 2022, three in 2023, and two in 2024. In March, the Fed raised rates by 0.25%, its first hike in three years.

On the domestic front, the Reserve Bank of New Zealand (RBNZ) has revised its projection — the official cash rate (the rate banks use to calculate cost of funds) is expected to reach 3.35% by the end of 2024. This was against the 2.6% estimated in November last year. The RBNZ has hiked rates three times since October 2021. The OCR is currently at 1.5% (20 April).

The key drags on U.S. and global economic growth are unchanged: disruptions to the production and movement of goods and services caused by COVID and its variants; and weak consumer sentiment affecting consumption.

Consumers are likely to withhold discretionary spending when they start to feel the inflationary impact of goods and services caused by higher global oil prices which will eventually flow into higher manufacturing cost, and ultimately the cost of consumer goods.

A worst-case scenario paints higher inflation crippling economic growth in the US and the world, leading to an era of high inflation and low growth, or stagflation. A more optimistic view sees inflation as a temporary event, and the economy will resume its upward trajectory from before Russia and Ukraine caused the current headwinds.

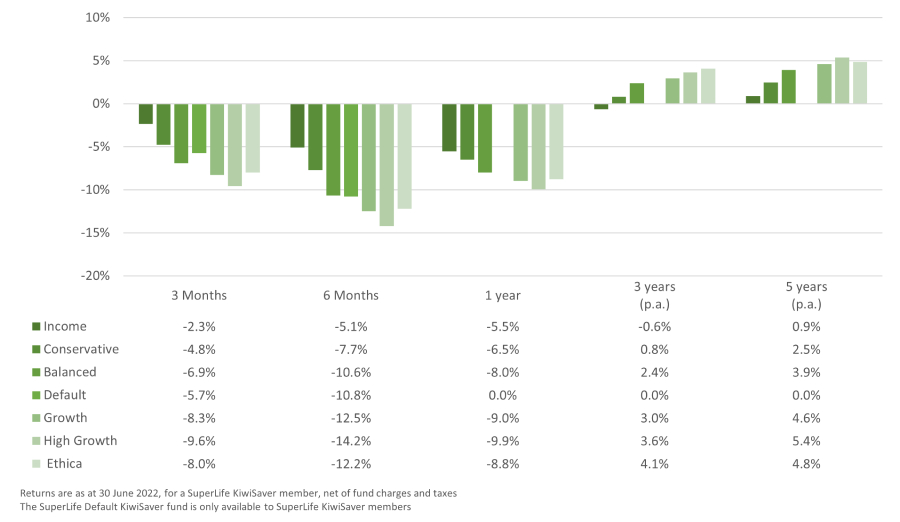

SuperLife Diversified Funds as at 31 March 2022 – How they performed

(Note: Past returns are not indicators of future performance)

Handling a volatile market

Given the markets are expected to stay volatile, returns will be lacklustre. One reality of having investments is coping with fluctuating returns. What the market is experiencing is, and will be, no different to any other times in the tumultuous life cycles of financial markets.

In New Zealand, COVID’s entrance in 2020 caused havoc, and panic. But investors who sold or moved out of their investments had to absorb their losses. Those who resisted the urge to switch, got to witness the sea of red returning to black.

How we watch over your investments

At Smartshares, we have an investment oversight team whose job is to continuously put our investment strategies under stress tests. This exercise keeps us vigilant, and helps reduce the impact of volatile markets on our members’ assets. Last August, we did three things as we anticipated changes in the interest rate environment:

- We started to increase the amount we invest in cash and cash equivalents and reduced investments in fixed assets in our diversified and Age Steps fund to reduce members’ exposure to rising interest rates.

- We reduced our holdings in Australasian and international equities, and increased investments in infrastructure and listed property funds. Infrastructure and listed property funds generally perform better in periods of higher inflation.

- We reduced our currency hedging target as the New Zealand dollar tends to fall when markets are more risk averse. This means there will be natural hedge against losses in the international markets as our currency falls.

Key takeaways

- Given the markets move in cycles, it is crucial to have a diversified portfolio – this means being invested in different types of assets, in various geographies. Diversified funds are less prone to the effects of geopolitical and economic risks. The SuperLife Income and SuperLife Conservative funds are designed with exactly this type of market volatility in mind. Most of our diversified funds also have a mix of income and growth assets to ensure some protection against large downward moves in share markets .

- As world central banks raise interest rates, bonds will be affected as investors adjust their outlook for interest rates and inflation. Government bonds which are viewed as ‘safe havens’ tend to do better than corporate bonds in an uncertain environment, and can offset losses in stocks should the situation worsen. Bonds now offer the highest yields they have in almost five years.

- This part of the investment cycle favours defensive stocks that can weather rising input costs. This includes listed property and infrastructure stocks that have long-term leases and long-term fixed borrowing rates. Some stocks, however, will be affected by the higher cost of capital, and corporate margins will be squeezed by the rising input costs. Due to recent falls, stock market valuations are much more attractive that they were, particularly in growth sectors, such as technology.

- The markets will take time to gain comfort that central banks can successfully rein in inflation without having a significant negative impact on economic growth.

- If you are not sure whether you are in the right diversified fund, or are uncomfortable with the negative short-term returns, or think your investment time-frame has changed, please don’t hesitate to call one of our nominated representatives.

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

The SuperLife Age Steps option lets you set your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you are concerned about your investments, or would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or phone 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.